Last Phrase

It is necessary for individual that borrows money to understand the brand new price and terms of its Apr, along with whether it’s fixed or varying. This permits the latest debtor to ascertain a spending budget, explore the mortgage wisely, and make consistent costs on both principal mortgage equilibrium and you can the interest into right out of credit currency. Contradictory otherwise were unsuccessful repayments makes a distinction in the complete quantity of interest paid over the lifetime of the loan.

Related Training

Thank you for learning CFI’s reason away from Apr. CFI offers the Financial Acting & Valuation Analyst (FMVA) certification program for those trying just take their professions towards the 2nd level. To keep reading and you can continue your career, next CFI resources would be of use:

Brand new Annual percentage rate (APR) ‘s the annual rate a financial or monetary company fees into an investment otherwise financing. It is a way of calculating an excellent loan’s total price over a time period of one year. Apr covers the newest loan’s yearly interest, running charge, charges, or any other costs.

Simple fact is that total cost that a loan provider costs towards financing getting annually. One can possibly determine new ount. New debtor must pay brand new Apr in addition to the dominating. It comprises brand new nominal interest and other costs associated with the loan.

Table from content

- What is the Annual percentage rate (APR)?

- Apr Informed me

- Formula

- Computation Analogy

- Faqs (FAQs)

- Required Articles

Secret Takeaways

- Brand new apr is the rates energized because of the lender into the lent matter or money over a-year.

- It will be the cost of borrowing from the bank or borrowing, since it reveals what amount of financing individuals shall pay off within the conclusion the period.

- age because rates. It is greater than just rates of interest since it is sold with rates in addition to charges, home loan brokerage, and other charges.

- It is out of a couple many types: repaired and you may adjustable Apr. Fixed Annual percentage rate does not answer changes in new list, while varying Apr transform with the list interest rates.

Apr Explained

You are free to make use of this image on your own site, templates, etcetera, Delight provide us with an enthusiastic attribution hook up How exactly to Bring Attribution? Article Link to become HyperlinkedFor like:Source: Apr (APR) (wallstreetmojo)

An annual percentage rate is the rate recharged on the loan or won on the a good investment more annually. Its, inside easier terminology, a way of measuring the price of borrowing or even the borrowing from the bank debts illustrated as the a portion amount annually. Apr is sold with Attention and you can one fees connected with the transaction. The speed for each and every fee months is multiplied because of the amount regarding fee attacks inside a year to arrive at that it number. The brand new shape accurately reflects the actual, purpose, loans in Odenville and perfect cost of borrowing from the bank currency. It is a word associated with financing, mortgages Mortgages A mortgage loan was a contract that delivers the fresh bank the right to forfeit the fresh new mortgaged possessions or possessions when you look at the case of inability to repay new lent share and you can interest. read more , and you will assets Assets Assets are generally assets discovered at establish having the newest expectation from highest yields afterwards. The practices are foregone now for pros one people can reap from it later. find out more .

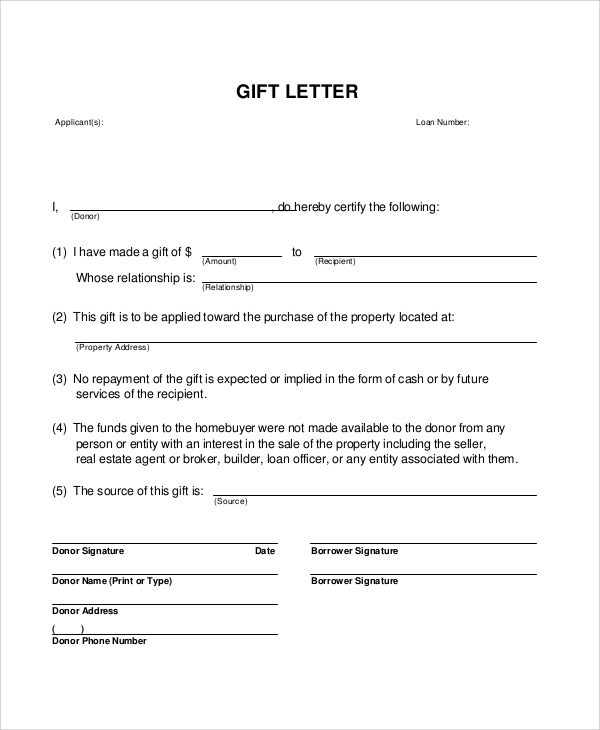

The annual percentage rate on mortgage charges includes loan points, loan origination fees, property inspection fees, mortgage insurance premiums, mortgage broker Mortgage Broker A mortgage broker is an intermediary that liaisons between the mortgage borrower and mortgage lender. Such brokers are responsible for gathering information, documentation process concerning income earned, an asset owned, credit report, and employment details to assess the borrower’s ability to secure financing. read more fees if any, and other loan transaction costs. These charges are levied in addition to the payment of Interest. Since interest rates are not inclusive of the above charges, it is lower than APR. With the above expenses deducted, the money received will be less than the requested amount. APR can be thought of as the rate of return Rate Of Return Rate of Return (ROR) refers to the expected return on investment (gain or loss) & it is expressed as a percentage. You can calculate this by, ROR = <(Current>* 100 read more on a loan, considering the costs involved. Similarly, the interest rates on credit cards are usually expressed as an annual rate. This is referred to as the annual percentage rate on credit cards. If individuals pay their balance in full each month by the due date on most cards, they can avoid incurring Interest on purchases. This way, individuals can reduce the annual percentage rate on credit cards.