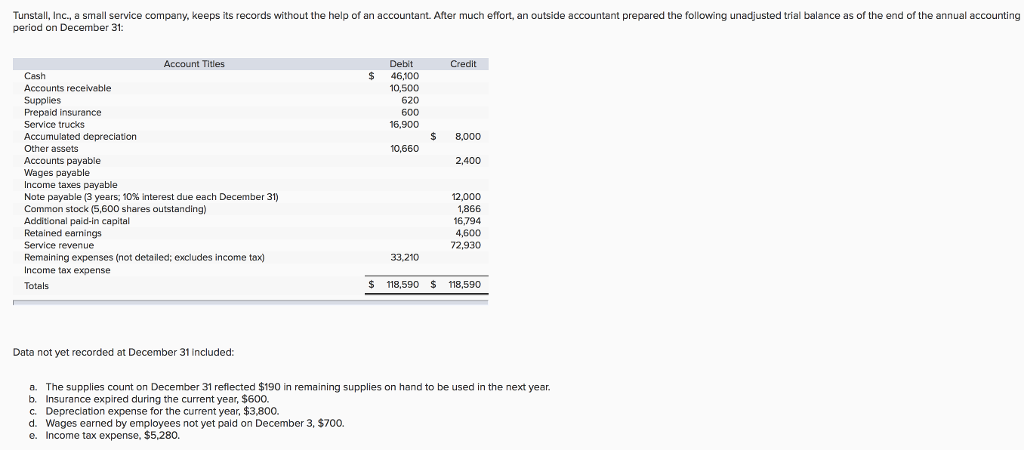

HAP C, within step 1,330 sqft, is a two-storey alternative on totally new homeownership system list. HAP customers you certainly will desire have the bathroom upstairs otherwise downstairs. (Screenshot through the NWT Property Corp.is why 1989 HAP Catalog)

The mortgage importance of brand new Nunavut Homeownership Recommendations Program is truly somewhat a big departure regarding the old-concept HAP, says Jimmy Fundamental, vice-chairman of surgery for Nunavut Homes Corp.

Regarded as HAP 2.0, new property firm revealed NHAP inside the August within the territorial government’s Nunavut 3000 initiative to create 3,000 belongings along the territory of the 2030.

The initial homeownership system, started in 1983, welcome visitors to like property construction away from a list, found materials 100% free and create their residence on their own, otherwise by using nearest and dearest or a company. The new effort live for approximately ten years.

The present iteration wants people to pay for – most likely through a mortgage – the latest homes rent, foundation, subcontractors, and just about every other most expenses associated with the fresh new make.

We have been merely within the a unique time, told you Chief. If we planned to defense 100 per cent of one’s can cost you per of those subscribers, we had apt to be giving a couple of otherwise four, unlike ten to fifteen this current year.

The initial system lead to in the 1,100 HAP home. Nevertheless authorities noticed the customer pond got dwindled, with few obtaining the necessary knowledge by mid-90s to participate.

However the system is actually widely sensed a success. HAP is rates-energetic, grabbed pressure from personal homes, and you can instilled a feeling of pleasure among residents.

The brand new houses firm intends cash loan usa Breckenridge Colorado to possess clients in order to still render sweating collateral, Main told you, but the majority will require rented assist, about to own plumbing and you may electrical.

He knows of many Nunavummiut deal with barriers of getting mortgages. In the past, the corporation has experienced to start its very own inner credit programs.

The primary circumstances, predicated on Fundamental, was one to Nunavut residents try not to own the newest property their house sits to the and you can lenders never offer design financing.

NHAP mortgage requisite highest departure’ regarding totally new system: NHC

They don’t have to take much risk upwards here, the guy said out of financial institutions, adding the guy intentions to talk with RBC, CIBC, and you may Earliest Countries Financial to track down a solution. If not, we’ll more likely needing to restore our very own inner investment program.

Maddie Cheung, media director in the Canadian Lenders Organization, said the users don’t have a special exposure urges to have Nunavut website subscribers.

For each and every condition is special, and financial institutions generate lending choices according to the chance of the debtor and the assets, she published into the a contact.

In an interview, Very first Nations Lender movie director Kathleen Gomes said the largest barriers some one deal with is actually rescuing getting a downpayment and you can excessive costs – the former as Nunavut is costly, in addition to second because their own part gives predicated on appraised thinking, perhaps not the fresh have a tendency to-higher buy costs.

She told you her financial even offers structure resource, nonetheless it releases money in line with the portion of done really works: If you’ve got little constructed on this site, then i can’t progress things.

Regardless if Nunavummiut normally in order to get mortgage loans, or even the housing agency devises a unique mortgage scheme, some believe the cost usually discourage candidates.

He told you people in the community cannot build adequate money to cover the the excess cost of the application form, therefore he does not think of several NHAP units is certainly going upwards there.

I’m not sure if people tend to use, Apsaktaun told you. Particular probably will. But most some one will most likely not get approved since it is a bit a good part.

(16) Comments:

The initial HAP program was a good flop. All the HAP home during my area was indeed either turned back once again to your neighborhood property connection otherwise were offered from the owner at the a huge profit following residence specifications got found. Why would a person choose purchase temperature and you can stamina, assets taxation, insurance and repairs when that load might possibly be given towards Canadian taxpayer?