- Renovations otherwise improvements become more high and they are normally carried out to switch the house or property, raise its value, otherwise allow it to be more appealing in order to clients. Renovations may include setting-up an alternative cooking area, adding an extra place, otherwise upgrading the toilet.

Such as for example, when the a tenant records a leaky faucet regarding the cooking area, brand new ATO tend to consider this to be a servicing getting tax objectives. You can allege the expense off replacement the brand new faucet since tax-allowable expenses. If, but not, you opt to change the whole kitchen area within the fix processes, the fresh ATO manage think of this a renovation, and you will claim write-offs toward decline towards the restoration will set you back.

So you can allege an investment expense, you need to request a quantity Surveyor and now have all of them ready yourself a tax decline plan.

An income tax depreciation plan is a report detailing the new nonexempt deductions you can claim towards deterioration of the investment property and its particular plant and you can products property. For individuals who already have a decline statement, you can simply contact extent Surveyor you to initially drew it up and encourage them to amend it to consider new renovation you’ve got finished in terms of investment allowances.

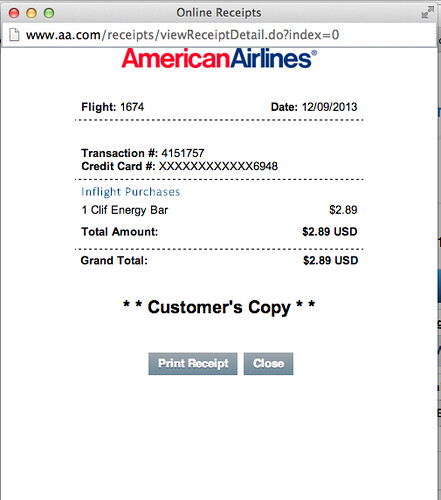

Essentially, try to keep detailed details of your own renovation’s resource expenditure and design can cost you, also statements, receipts, and you will any deals or preparations. If you done this new home improvements a while ago and only just heard of saying depreciation, their Numbers Surveyor can also be search the house, perform a fees estimate and backdate the depreciation allege.

If you would like allege depreciation and take benefit of the latest tax benefits associated with disregard the possessions renovations, envision dealing with Duo Income tax.

All of us away from educated and you may qualified Numbers Surveyors makes it possible to with a new depreciation agenda, amend an existing agenda, or backdate their claim to the funding expenses. I utilize the most recent technology and techniques to be sure your income tax decline agenda is actually direct and you can maximises their write-offs.

Contact all of us right now to find out more about all of our functions and just how we can save towards the tax.

Just how can Renovations Impression Investment Development Income tax on the Leasing Assets?

The expense of home improvements for the a residential property normally put in the property’s rates ft, determining the capital acquire or losings whenever promoting assets.

The cost ft includes the first purchase price, acquisition will set you back, and also the price of one capital developments built to the home. With the addition of the price of home improvements on prices foot, you can slow down the financing get and you may, for this reason, the level of capital development taxation (CGT) you borrowed from when you offer the property.

Including, for individuals who bought a house having $five-hundred,000 and you will spent $fifty,000 towards home improvements, the fresh new property’s rates feet would be $550,000. For many who after that offered the house having $800,000, the main city obtain will be $250,000 ($800,000 $550,000) instead of $three hundred,000 ($800,000 $500,000).

For those who have completed renovations in your leasing property however, did not keep track of the expenses, you could potentially purchase a great Duo Tax Investment Growth Report to pick the increase inside the financial support will cost you, which you’ll enhance your own prices foot, leading to a lesser financing get to possess tax aim.

Secret Takeaways

Remodeling a residential property will be a powerful way to incorporate value and increase your productivity on your investment. They also include the https://cashadvancecompass.com/personal-loans-ne/ added benefit of income tax deductions, which you’ll allege by way of investment work write-offs.

If you remain outlined ideas, seek expert advice, and you may work with a qualified wide variety surveyor such as for example Duo Income tax, you can reduce your tax bill while increasing your own productivity toward funding.