The fresh new reported home loan costs on their website aren’t want borrowing many 720+ and reasonable LTV prices including 70% maximum. While doing so, max DTI try 43%, hence fits towards the Signed up Home loan (QM) rule.

It be seemingly a beneficial .125% if not .25% higher than exactly what I’ve seen recently together with other huge lenders, such as for instance Economic off of the united states otherwise Wells Fargo.

Why are ditech Home loan Other?

- He or she is a reliable brand i’ve heard from

- Is even originate financing with few overlays courtesy strong support

- And they have a great correspondent financing section

- Plus an over-all program

Aside from the lowercase identity, he’s numerous publication properties. For one, they are an established brand with many support at the rear of him/her, so they are able originate loans with few institution overlays.

That means you’ll utilize way more competitive and versatile monetary underwriting direction one most other finance companies and you can mortgage lenders may possibly not be willing to promote.

They also supply the Federal national mortgage association MyCommunityMortgage, brand new FHA’s $one hundred down payment funding program, expanded lender-reduced home loan insurance coverage, and Freddie Merely system, providing these to handle LP (Financing Prospector) results out of Freddie Mac.

In the event you delivering good correspondent bank, you’ve got the capability to speed, secure and you can send private money through the ditech webpages.

On the whole, it appears as though just what will place them away is the size/backing/common identity. We commonly contemplate your ex lover which are enough giving all of them a plus, or perhaps a feet into the entranceway.

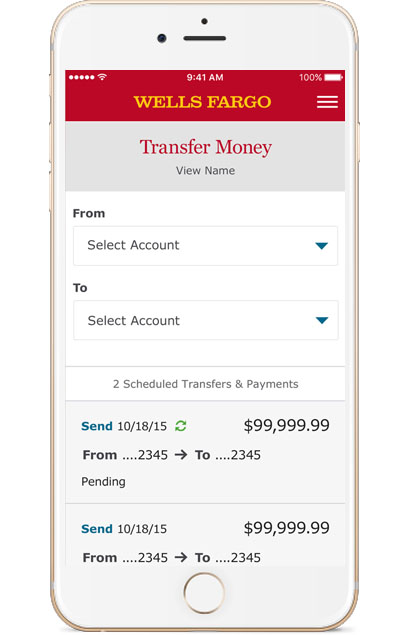

I wish to pick a bit more technical from their store provided their within this title, but not, they have produced zero regard to to be able to complete during the data files online and/if you don’t track new position of financing on the web. That would be an enjoyable touching, specifically aided by the fintech players growing contained in this lay.

They simply research a while common no actual novel features if the things, it is like a great throwback in order to 10 years back, in the place of yet another eyes.

In the long run, simply to get this upright, three major lenders (and several smaller of them) took place inside introduce land crisis, and Nationwide, IndyMac, and you will GMAC.

Now, they have morphed on the Lender of one’s usa/PennyMac, OneWest Lender, and you will ditech, correspondingly. Its interesting observe whatever they end up being this time once the our home mortgage career will continue to recreate in itself.

Update: Ditech now offers mortgage loans with only step 3% away from through the the newest Fannie mae 97 system. In addition, it has just revealed a general credit channel and generally are now recognizing programs of loan providers.

Ditech Manage-end up being on the market

- The business revealed for the later

- It was exploring proper solutions

Within this quick many years due to the fact cluster relaunched, ditech says these days it is investigating strategic choice towards the let-off Houlihan Lokey as their monetary mentor.

Thanks to rising home loan costs, of a lot stores enjoys commonly signed otherwise ended up selling-aside additional opposition. And exactly how things are supposed, capital origination volume has a tendency to lose then.

Therefore it is unsure installment loans for bad credit in Kansas City Kansas if your business is simply looking to throw into towel early in advance from something receive any difficult, or if there is one more reason within butt of new step.