Matta, 32, had merely leftover a position due to the fact vice president at the Goldman Sachs to begin with Crescent Crypto, an excellent crypto investment management enterprise, and more than from their websites worth was tied from inside the Bitcoin and you may Ether loans Blanca. Even when Matta, now brand new U.S.-established chairman away from 3iQ Electronic Possessions, was pleased with the positioning key, as he wanted to get home, banking companies such as for instance JPMorgan and Financial from America told him he would not get a mortgage to some extent because of high-risk assets the guy owned.

Immediately after becoming turned away by several financial institutions, the guy with his wife altered way. Regardless if each of their names was basically towards mortgage, they made a decision to just use the fresh shell out stubs regarding their particular non-crypto-associated jobs, their unique tax returns, and her assets to the bank’s confirmation, hence invited these to get the home loan it wanted to get the condo.

Unfortunately most of the real estate industry, the traditional financial financing room, does not really mesh into the crypto place. It’s not extremely acknowledged. In reality, it’s actually a mark facing your, Matta told you.

Milo states function as basic crypto lender that offers a 30-year financial, but it’s perhaps not the only real pro regarding the crypto home loan place

The new housing market has never been a whole lot more congested, and pandemic has actually brought about property pricing over the U.S. to help you rise. Matta is short for an increasing number of individuals with serious crypto holdings who have the newest wealth to acquire property however the latest cash, and they have come upon troubles when searching for old-fashioned mortgages. But a new player keeps came up to handle this gap when you look at the industry: crypto mortgage brokers.

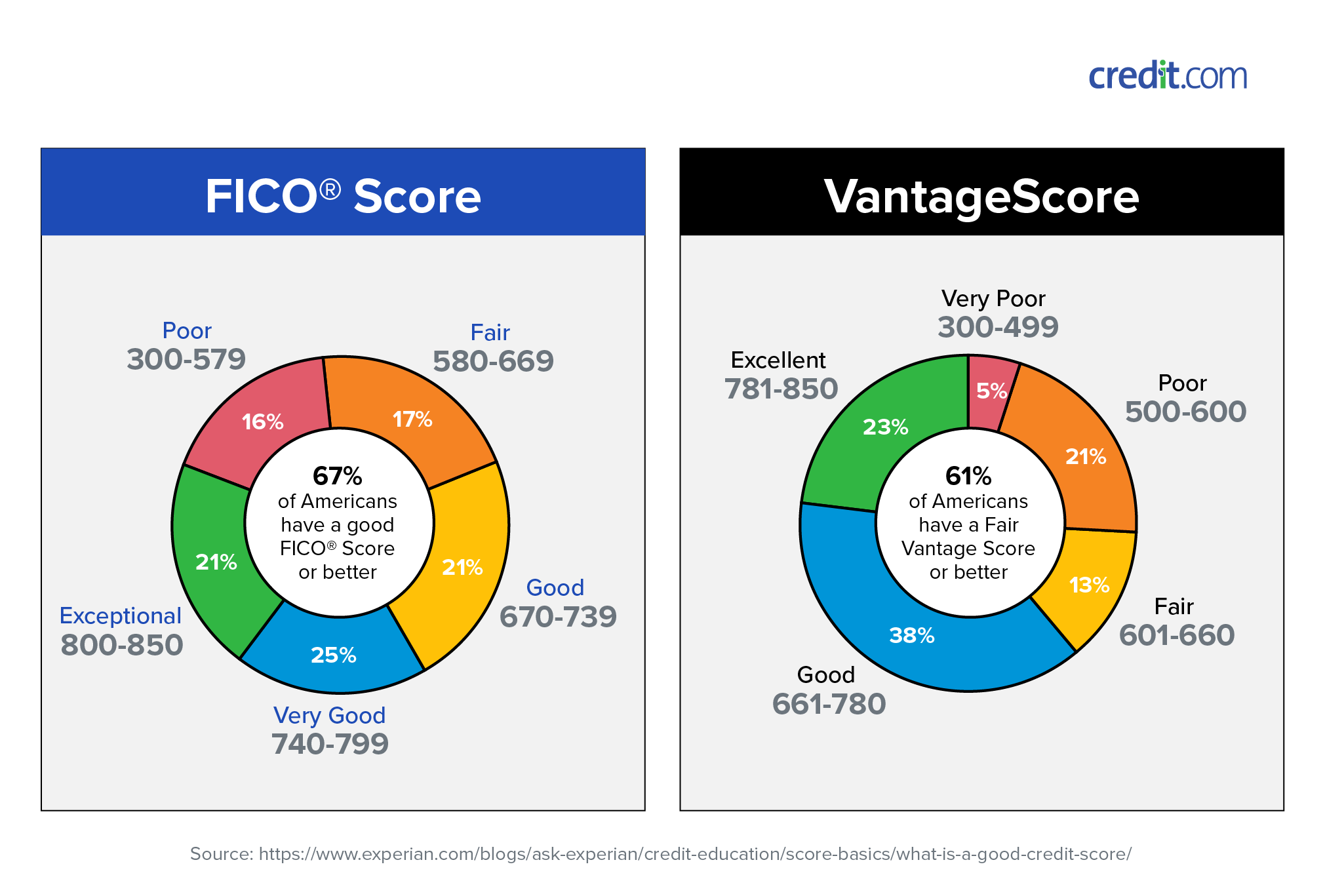

History month, Milo, a crypto mortgage lender, circulated an excellent crypto mortgage agency where members can use for financing to get You.S. a home whenever they set up a similar sum of money when you look at the Bitcoin. Instead of having fun with a cash advance payment, a good FICO credit assessment, or income to your a taxation return to have a look at a prospective borrower’s creditworthiness, Milo assesses potential individuals according to their crypto riches and value of the property he or she is aspiring to buy. For example, anyone searching for good $five-hundred,000 financial will have to establish $five-hundred,000 value of Bitcoin, Milo Ceo and you will creator Josip Rupena advised Luck.

In return for securing up the crypto, borrowers get a 30-12 months financial because of their house get, in fact it is paid-in monthly installments to Milo. Rates into the mortgage start from 5% to 8%, and are very different with regards to the number of Bitcoin the individual is install given that collateral.

Rupena states the rate can also be adjusted annual centered towards the price of Bitcoin: In the event the price of Bitcoin increases, individuals might take out some of its crypto at the you to definitely-seasons draw. In case your price of Bitcoin decreases, they’re asked to provide a lot more crypto due to the fact security. Crypto home loan individuals can manage to get thier Bitcoin right back once they pay the loan entirely, and can together with end attempting to sell the crypto to exhibit proof of assets to a classic lender, following paying taxes inside it, Rupena said.

Rupena told Fortune that there’s a waiting set of a great deal more than 7,000 anybody for its crypto financial items, however the company has never disbursed its earliest financing, and then he declined to say exactly how many subscribers the company is now working with.

There are lots of people who at this point in time provides a life threatening portion of the riches, and even for some ones, all their websites really worth when you look at the crypto, and current home loan choice won’t work for them, Rupena told Fortune.

S. home loan company, Michigan-established Joined Wholesale Financial, told you it might initiate acknowledging crypto from the consumers as part regarding a beneficial pilot system

Inside the December, cryptocurrency financial Ledn got a wait-listing discover having an equivalent crypto financial product. Apart from these types of a home specific crypto financing, other companies, and BlockFi, give crypto collateralized money that can be used to shop for land. A special financial, Nexo, reported for the 2019 to own given out a beneficial crypto financial to help you business person and you may previous star Brock Enter to get an effective $step 1.2 billion lso are.

Antique lenders have made an effort to mix their organizations which have crypto. Past August, next-biggest You. Six-weeks afterwards it stopped acknowledging cryptocurrencies because of incremental costs and regulatory suspicion.

Nevertheless, exactly how many individuals who is finding an effective crypto home loan is quite minimal, predicated on Matthew Sigel, your face away from electronic assets search at VanEck, a keen ETF and you may common money movie director.

Sigel told you VanEck doesn’t have a share in any crypto home loan organizations particularly, but Cadenza Ventures, an early on-stage crypto financing one to VanEck purchased, was an excellent seed products trader into the BlockFi, and also purchased crypto financing enterprises beyond your U.S.

Old-fashioned lenders given a projected $1.61 trillion when you look at the money during the 2021, with regards to the Mortgage Lenders Connection. To possess crypto mortgage and you will financial items to catch on, Sigel says, might want to get to the point where members usually do not need to build normally crypto once the equity, and you will alternatively flow closer to the fresh new 20% off model having mortgages that numerous banks play with. But he believes the expansion of these crypto financing products could be another hazard for conventional loan providers.

The extent is fairly quick immediately, but this is actually the suggestion of one’s sphere one to ultimately presents an enthusiastic existential possibilities to financial income, Sigel said.

Never skip a narrative: Go after your chosen subjects and you will article authors to locate a personalized email to the news media that matters extremely for you.