Daniel Pietrzak: To take into consideration it generally, contemplate loan otherwise credit products that financing the genuine-globe benefit. This isn’t antique corporate borrowing from the bank, not typical money in order to enterprises. We estimate that ABF is a $5 trillion field and you may growing (Showcase step 1). Along with all that, there’s not been plenty of scaled capital raised when you look at the the room.

Asset-Established Fund (ABF) could have been grabbing the attention many buyers who’re searching for taking advantage of private borrowing expenses, while also diversifying their profiles. New house category are huge, level many techniques from consumer loans to help you mortgages to audio royalty contracts.

Daniel Pietrzak: To take into account they generally, consider mortgage or borrowing from the bank products which money the genuine-world savings. It is not old-fashioned business borrowing from the bank, not normal financing so you can people. We imagine one to ABF was an effective $5 trillion field and you may expanding (Showcase step one). With all that, there’s maybe not already been many scaled investment increased inside the the room.

We sat off recently which have Daniel Pietrzak, All over the world Head off Personal Credit, and Varun Khanna, Co-Direct off Resource-Situated Funds, to discuss where potential was, in which the dangers is actually, and you may what they come across to come for another 12 months

Is short for the non-public financial assets got its start and you can stored of the low-banking companies dependent in the world, related to domestic (including mortgages) and you will company credit. Excludes fund securitized otherwise offered so you’re able to government firms and assets received regarding the financial support areas otherwise through-other secondary/ syndicated avenues.

We seated down recently that have Daniel Pietrzak, Global Direct away from Private Borrowing, and you can Varun Khanna, Co-Lead off Investment-Based Fund, to discuss the spot where the solutions is, where in actuality the dangers was, and what they find ahead for another one year

Means the non-public financial possessions originated and held of the non-banking institutions based internationally, associated with household (as well as mortgages) and organization borrowing. Excludes financing securitized otherwise ended up selling so you’re able to regulators companies and you can possessions received regarding resource locations or through other supplementary/ syndicated streams.

Consumer and you may mortgage money is the biggest the main field. Fundamentally, the audience is investing in shielded financing profiles. They can be protected by a house in the example of mortgages otherwise autos when it comes to car finance profiles, to-name several instances. You will find as well as concerned about home improvement funds and other safeguarded profiles off funds to help you prime borrowers, for example recreational automobile (RV) money.

Industrial finance is sold with a great amount of financing one banks familiar with perform but i have removed straight back on the of late. Normally, which involves loans so you’re able to commercial borrowers protected of the its extremely important assets. Stimulate Resource, in which we let offer funding so you’re able to Irish homebuilders, is actually an example of that. Once the a unique analogy, we’ve got produced expenditures backed by exchange receivables to own a big methods company.

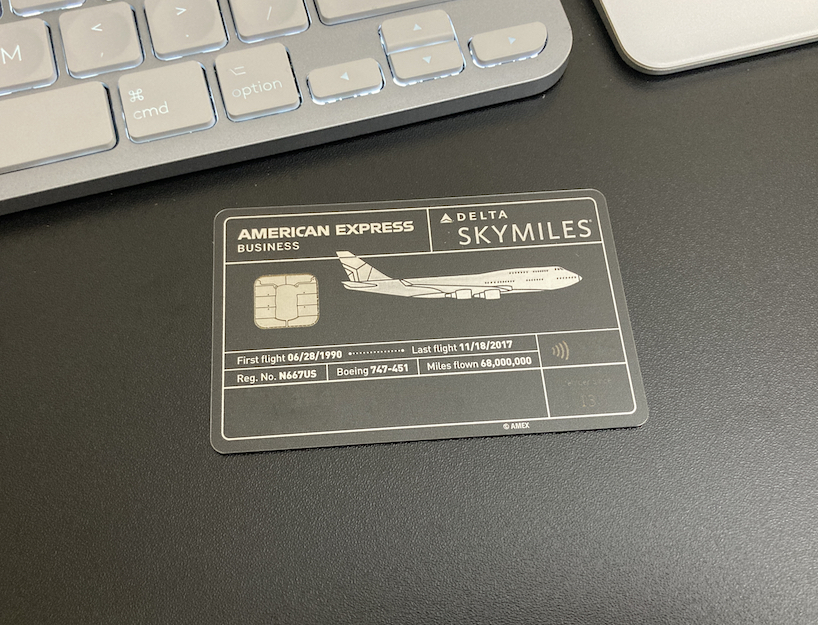

As soon as we put money into hard property, we really own and you may handle the root property, and therefore we believe could possibly offer a degree of downside shelter. Those possessions generally build lease money, fundamentally more than a somewhat considerable length of time. Aviation local rental or unmarried-family members local rental homes is samples of this.

Integer Advisors and you may KKR Borrowing research rates predicated on newest readily available study since , sourced off country-specific official/trading bodies in addition to organization reports

Contractual bucks moves was more from the work with. For example, the music royalty place are a location in which we’ve been active. We love so it section for its attractive income profile together with decreased relationship towards broad cost savings.

Varun Khanna: Financing professionals and you can markets professionals have been worried about if or not here would-be a hard obtaining, how individual usually food, as well as how house costs commonly circulate, which enjoys an immediate hit toward money results out of ABF. We have been a lot more choosy and more conservative when you look at the determining dangers. Even though, I have https://paydayloanalabama.com/forkland/ already been amazed discover we’re busier within the 2023 than in the past. The reason behind that’s the tall dislocation both in the latest banking business while the social capital places.