Erika Rasure is globally-thought to be the leading individual business economics topic professional, researcher, and you can instructor. This woman is an economic counselor and transformational coach, with a special demand for enabling feminine learn how to invest.

What’s an ending Declaration?

A closing report is a file that suggestions the facts from a monetary purchase. A homebuyer who finances the purchase are certain to get an ending statement on the lender, as the family merchant will get one to throughout the a property agent which treated the fresh revenue.

Secret Takeaways

- A home loan closure report lists all the will set you back and you will charges of loan, together with total matter and you will payment schedule.

- A closing report or borrowing from the bank contract is offered any kind away from mortgage, commonly into the software alone.

- Good seller’s Closing Disclosure is ready by the money agent and you may directories the income and will set you back in addition to the websites full to be paid down into the vendor.

- With kind of fund, you may want to receive a reality in the Lending Revelation mode in lieu of a closing Disclosure.

Understanding the Closure Declaration

Whenever money a property get, consumers can get observe a loan guess in this 3 days from making an application for a home loan. In advance of closure, the buyer will get the final Closing Disclosure. If you find yourself the seller, you are getting a similar Closure Disclosure you to shows your information along with your liberties and you can personal debt because supplier.

The borrowed funds Closure Declaration

Training and acknowledging the past Closure Revelation is amongst the last tips one to a debtor has to take before you sign towards dotted range and you can recognizing the bucks to own a mortgage otherwise refinancing.

The past Closure Disclosure is preceded by mortgage estimate, which estimates the various fees and extra fees that the debtor usually face from the closing. The past Closure Disclosure ought not to are very different somewhat about first mortgage guess. The borrowed funds imagine should be gotten inside three days off entry the loan software.

The final Closing Revelation need to be provided to this new borrower at the minimum around three working days ahead of closing. It has an in depth variety of most of the payment and you may fees one the fresh borrower are required to blow, and whom it would be paid back. The terrible count due could be adjusted to help you mirror any can cost you currently paid down of the debtor.

The very last disclosure will additionally introduce all of those data front from the front side on 1st loan guess for simple research. What’s more, it includes the important points of mortgage, including the rate of interest, the amount of the monthly installments, and also the commission schedule.

You will need to carefully review the loan closing declaration, in order that things are best also to identify any inaccuracies.

Other Mortgage Closure check here Comments

Almost every other different kind off financing has a unique closure report. It file can certainly be titled a settlement sheet or credit arrangement.

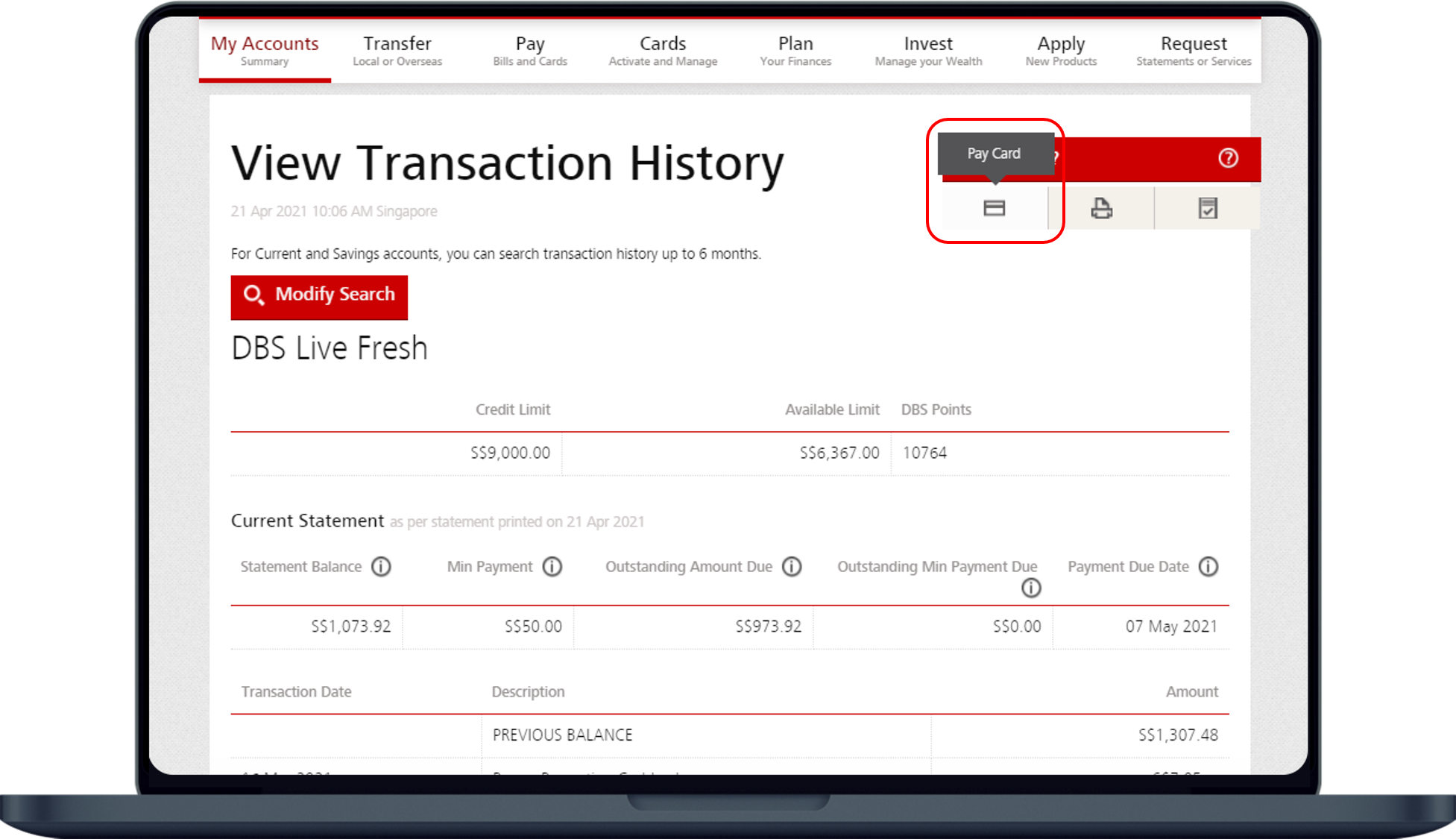

Inside an excellent revolving borrowing loan, particularly a separate mastercard or a bank distinct credit, the fresh closure info are often said regarding the borrowing from the bank application, toward borrower’s trademark indicating arrangement in advance with the financing conditions. An even more cutting-edge file is oftentimes useful unsecured loans you to encompass a huge lump sum payment, which have otherwise without equity.

When you are taking an opposing home loan, you would not obtain the practical Closing Disclosure. Rather, you’d located a beneficial HUD-step one Payment Report and a reality when you look at the Lending Revelation setting. If you find yourself making an application for a house guarantee credit line (HELOC), you may found a reality in the Lending Disclosure means however a good HUD-step one Payment Report otherwise a closing Disclosure.

Brand new Seller’s Closing Declaration

The vendor will have the past closing data, for instance the Closing Disclosure, off funds representative dealing with the new name business chosen to personal the order. This can list all of one’s commissions and costs becoming repaid, and additionally one loans in fact it is counterbalance against them. The bottom-range contour is when much owner will get since transaction is actually signed. The user Economic Defense Bureau requires that the vendor found this report.

When you’re attempting to sell a property during the a profit, you need this new closure declaration so you’re able to record the information of your income once you file their taxes.

Elements of an ending Declaration

The latest closure report includes suggestions pertaining to the expense of to get or promoting a property. The design may are information on the property by itself. What is actually integrated on your closure statement can depend to your whether you are the consumer or perhaps the supplier.

- Possessions information. Brand new closure declaration will include basic factual statements about the house or property, for instance the target where it’s receive, whether it try dependent, and also the type of framework its (i.elizabeth., single-home, multifamily domestic, are created home, etcetera.).

- Monetary information. The fresh new closure report should also outline the purchase price of the family, dumps paid because of the visitors, and you can merchant credits.

- Prorated numbers. In the event the a purchaser otherwise supplier is investing prorated number into the property fees otherwise people organization (HOA) costs, after that these and additionally was incorporated into the closure report.

- Financing can cost you. That it section of the closing declaration will include advice according to the loan, for example facts paid down, underwriting fees, software fees, and you will origination fees. Mortgage insurance costs and you will prepaid service interest also would-be included right here.

- Miscellaneous loan will set you back. Most other financing will cost you is indexed under a unique section. Filled with assessment fees, credit history costs, and you may lookup charge. Questionnaire charge, assessment charges, and you can pest inspection charge in addition to would be incorporated for the closing report.

Exemplory case of A home Closing Statements

Brand new American House Term Connection (ALTA) brings sample closure comments both for customers and sellers during the good a property purchase. This type of statements look equivalent, however, there are moderate differences in every piece of information that’s stated. Less than are a typical example of precisely what the supplier closure report seems including. The consumer closure statement will likely be installed to your ALTA web site, along with the seller declaration.