On top of that, you can find downsides to your financing. Inability to take action will get property all of them when you look at the hot-water then down the song. As such, borrowers need look before taking on the a state Farm Family Collateral Mortgage to make certain simple fact is that correct decision for their activities.

Fundamentally, County Farm Domestic Security Funds promote competitive rates, straight down charges, and much more assistance attributes out of certified masters. As a result, customers keeps higher opportunities to discover the possibility property value the homes in place of anxiety about generous monetary burdens down the road.

When you are insights whether or not a state Ranch Family Collateral Mortgage suits you is paramount, determining who’s eligible for these financing is merely as vital. We are going to speak about that it inside increased detail within our upcoming section in order to understand how you can best influence the circumstances to be certain your qualify for which mortgage system.

- Predicated on Condition Ranch, regular domestic security mortgage criteria is evidence of income, good credit history, and other facts for instance the amount borrowed questioned.

- Minimal loan amount to own your state https://simplycashadvance.net/title-loans-wv/ Ranch house security mortgage try $10,000, with a maximum of $250,000.

- Family collateral funds out-of Condition Ranch possess fixed rates that have cost terms and conditions readily available for to 15 years.

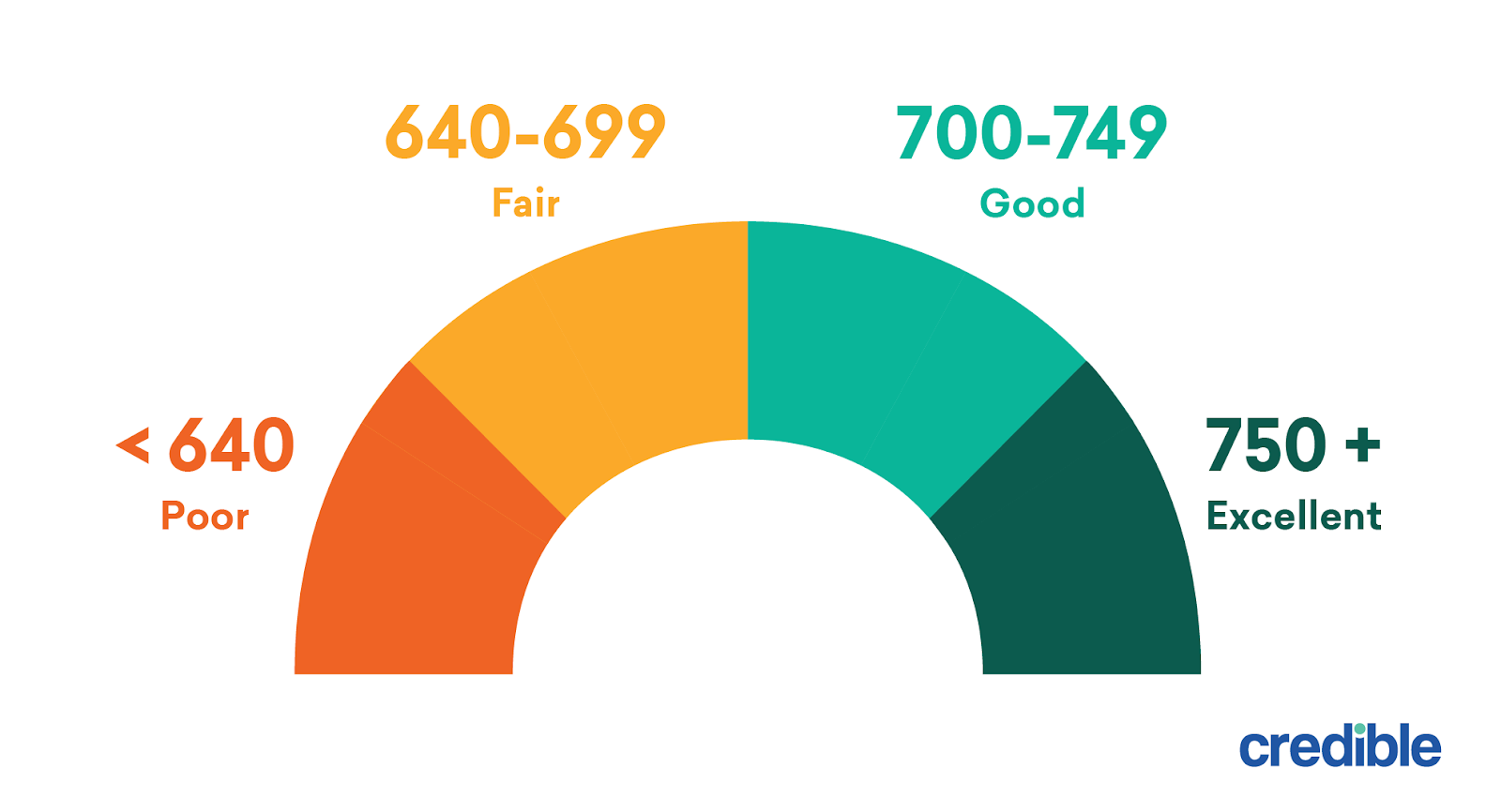

Qualifications for a state Ranch Household Collateral Financing relies on an enthusiastic person’s Credit score, Debt-To-Income (DTI) proportion, and also the guarantee in their home. Generally, a or advanced credit scores trigger down costs and higher loan amounts than simply anybody that have a diminished rating could possibly get be eligible for. Additionally, which have an income much less greatly burdened indebted payments in addition to helps safer a whole lot more favorable terminology. Finally, the amount of security in the home need to safety the real difference involving the value of the home in addition to amount borrowed desired, in addition to all associated fees and you can settlement costs.

Brand new disagreement for having significantly more strict qualifications guidelines would be the fact they reduces risk with the financial, leading to best words for the debtor on account of a higher loan-to-worthy of proportion. This is why, those with excellent credit ratings, reduced DTI, and enhanced home values gain access to competitive cost and big borrowing from the bank restrictions. In addition, people with lower score or higher DTIs can find their selection minimal on account of more strict eligibility criteria. Sooner or later, it’s important to see your financial situation and chat directly to an agent away from State Ranch before you apply having a house Collateral Financing.

Now that there is talked about who is eligible for a state Ranch House Equity Loan why don’t we look on the just what advantages such as for instance financing you certainly will provide you with because a resident.

Which are the Benefits of a state Ranch Household Collateral Mortgage?

Eager to open a full possible of one’s residence’s guarantee? Your state Farm Family Collateral Financing is what your you prefer. When you’re these funds have numerous gurus, possible consumers have to compare loan providers and points to discover the best financing that suits its economic need.

Particularly, consumers have to know what they’re entering about the cost computations and you will guarantee partnership having property equity mortgage

Advantages of a state Ranch House Guarantee Mortgage are yearly fee rates (APR) which might be usually less than credit cards or signature loans, allowing for way more value inside settling the loan. Simultaneously, the eye paid back with the a state Farm Home Guarantee Financing you will become tax deductible when borrowing doing $750,000*. This can cause extreme offers while the an individual’s book tax problem should determine if they subtract the mortgage desire. Additionally, State Ranch Domestic Guarantee Funds can provide borrowers having extra peace away from brain and balances since they include fixed prices and you can money across the loan’s lifetime.