Josh Rapaport

FHA money are great for very first time homebuyers in search of financing that does not need a massive advance payment or primary borrowing from the bank.

In this article, you can expect your with insight into FHA loan limitations and you can let you know what direction to go so you’re able to qualify for the mortgage. Continue americash loans Scottsboro reading to achieve alot more understanding.

Just how is actually FHA Mortgage Constraints Place?

What identifies the most FHA financing limitation? This type of financing should be thought about for those who have good reduced credit rating and would like to start by the lowest down commission.

But not, you can nevertheless believe in search of FHA jumbo mortgage limitations when the you want to pick a pricey household. Section Credit may also help you make our home-to order processes smoother if you need a costly home.

When it comes to FHA funds, things are always various other. There’s always a roof and the absolute minimum count you can qualify for. They usually are influenced by a few circumstances, which are;

- Location: The FHA condition financing limits usually disagree. The lending company commonly look at the town you reside in advance of giving you financing. The reason being discover lowest-cost portion and you can highest-pricing components. Such, when you need to buy a property into the California, La condition, you could get a higher matter than just somebody who desires a home into the Ca, Solano county.

- How many Tools We need to Get: Exactly how many gadgets to buy is even accustomed set FHA financing restrictions. If you like an excellent step three-unit possessions, you ount than some body to get a 1-equipment family.

The brand new Lending Constraints for FHA Fund

What is actually a keen FHA mortgage restriction? FHA credit financing restriction ‘s the limit or lowest quantity of currency which will be covered so you can a house buyer. This type of constraints usually are upgraded and you will adjusted per year and can feel impacted by the conventional constraints place by the Federal national mortgage association and Freddie Mac enterprises.

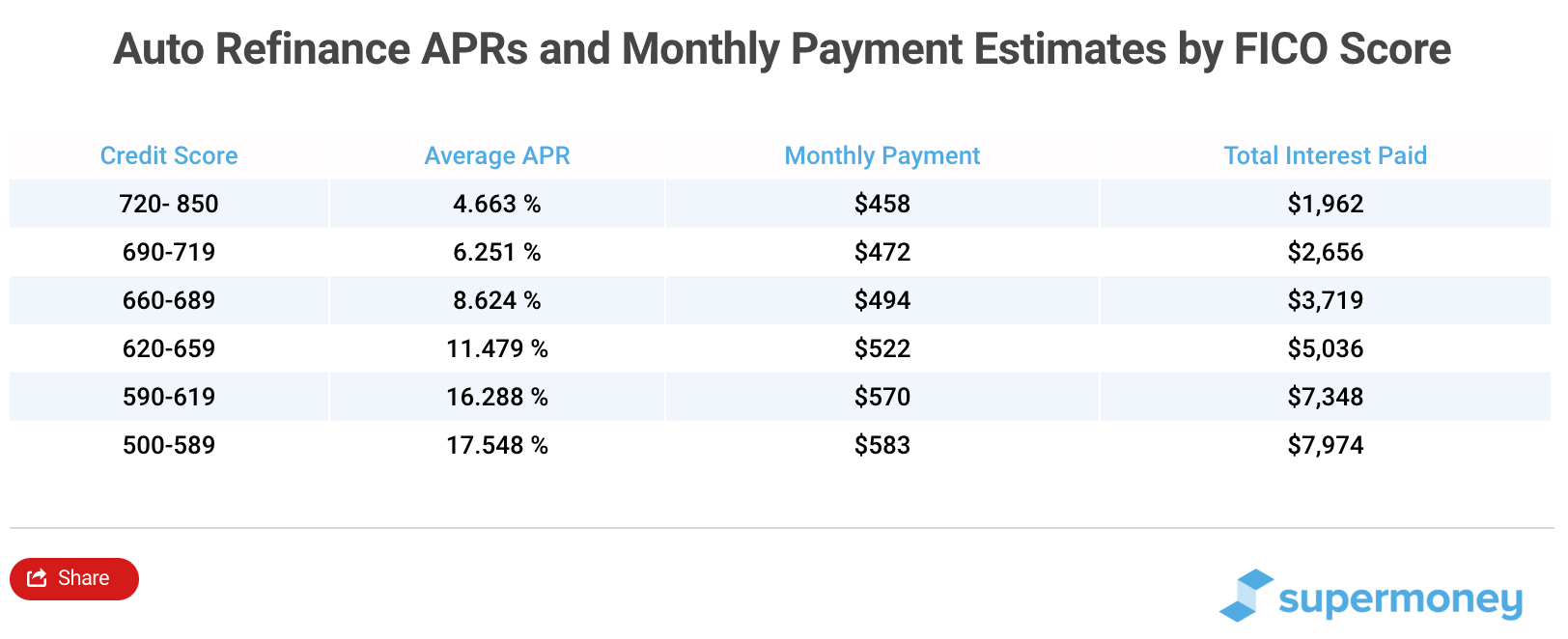

FHA loan limit 2021 to the higher-rates portion are $822,375, but which had been updated earlier this 12 months in order to $970 800. Concurrently, the FHA mortgage restriction set for lower-costs elements try modified to $420,680 when you look at the 2022. Here is a straightforward desk that will help you know the way far you could qualify for regarding your product you are to invest in;

Consider, the FHA multifamily financing restrictions may also disagree according to the location you reside or intend to pick a home. Clearly about dining table more than, FHA limit amount borrowed 2022 try $1.867,275, but it doesn’t mean that it is the actual number you can get once you make an application for the mortgage.

For folks who are from an area in which households meet or exceed one to count, you might be experienced for a high loan limit. Instance, into the Alaska, Guam, Their state, and you will Virginia Islands, the borrowed funds limitation to own a several-equipment possessions can move up to $dos,372,625. The mortgage limits expressed above was for the majority says and areas in the usa.

Why are FHA Restrictions Needed?

The new FHA financing constraints are essential because they offer a method off preventing the over-concentration of financing. This is really important due to the fact an over-intensity of credit contributes to bubbles, which can bring about serious financial ruin.

The brand new constraints also are needed while they bring a minimum basic for mortgage lenders to follow when approving lenders. In other words, it buffers the lenders and you may individuals, making certain loan providers dont render more is required. In addition suppress borrowers away from credit more than they could manage.

It prevents individuals away from over-leverage their houses and you will starting economic difficulties afterwards. Once they dont create repayments promptly or can not afford the fresh payment just after rates go up, it can be a problem for both the lender and you can debtor.