The fresh Wall structure Path banking large Goldman Sachs provides accessible to get a risk during the Trussle, an excellent Uk-oriented online large financial company, underlining new broadening cravings away from oriented loan providers to shop for monetary technology start-ups.

Sky Reports can also be show that Goldman’s Dominant Proper Opportunities (PSI) section is doing a near-?14m fundraising by the Trussle, that was based less than three years back.

Near to Goldman Sachs, most other the new backers of the electronic mortgage broker have been shown so you’re able to tend to be Propel, a trader which have links to the Spanish economic characteristics giant BBVA, that can possess a large stake when you look at the Atom Bank, british on the internet-simply lender.

Trussle are set-up of the Ishaan Malhi, a neighbor hood expert who chose to launch the firm immediately following are frustrated with his own mortgage software procedure.

« From year to year, millions of current and you may ambitious people are at the mercy of brand new exact same a lot of costs, waits, and fury that we experienced basic-hands when trying to get a home loan, » Mr Malhi said.? »Such community flaws was resulting in mans dreams of home ownership to slide subsequent out. »?The brand new cash loans in Falls Village CT wedding off Goldman’s PSI product when you look at the Trussle’s latest fundraising are celebrated of the Wall structure Roadway company’s today-repeated visibility given that a strategic backer away from timely-expanding fintech businesses.

During the 2016, Goldman obtained a share in the Ideal Financial, a great United states-oriented home-based mortgage-financing provider, whilst in latest weeks, it has got recognized initiate-ups such as Kensho, a document analytics program, and you can NAV, a supplier away from financial support to small enterprises.

Specifics of brand new Goldman-contributed financing bullet in Trussle will come simply days after the Town watchdog necessary significantly more invention in britain home loan market.

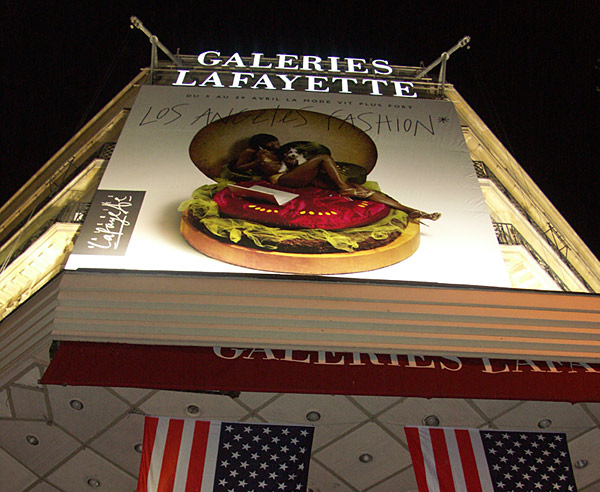

A good device of your own Wall structure Street lender are providing a stake in one of the UK’s extremely eyes-catching fintech businesses, Air Development finds out

When you look at the an announcement last week, the newest Financial Conduct Power said they desired customers required to identify in the an earlier phase the loan factors which they qualified plus the convenience that they could compare all of them.

« The loan marketplace is one of the primary financial markets in the united kingdom and there were significant change on industry given that overall economy to help you make sure we create maybe not come back to the poor techniques of history.

As an element of the operate to place alone since the a buyers winner, Trussle has actually recommended a home loan-modifying ensure just like that which today operates in today’s accounts and effort areas.

Mr Malhi states this particular would assist residents save specific of your own ?10bn his providers says goes to waste on a yearly basis when you are on a bad home loan package.

Verifying the latest financing of the Goldman and you may BBVA-supported Move, he told Heavens Reports:? »We are delighted to discover the desire and investment out-of a few around the world known loan providers which show all of our attention.

« It will be familiar with accelerate our very own development also to dedicate towards the tool sustainably, incorporating then automation to ensure we provide an educated experience you can. »?

Brand new fundraising comes at once from profound change in the Uk financial markets as the oriented members try to ward off more agile begin-upwards competitors, that have sworn so you can revolutionise the consumer feel by simply making new procedure of securing a property-financing faster and you will lesser

7m from other investors, including the early-phase trader Seedcamp and you may LocalGlobe, a bluish-processor backer of those British technical start-ups.

The company features denied to reveal the brand new valuation linked to they pursuing the fundraising that it is expected to mention towards Wednesday.

What’s more, it remains obscure in the most other procedures of their monetary abilities, although it states this has educated few days-on-week development of twenty-five%.

Mr Malhi enjoys put an objective from delivering as numerous mortgages among the half dozen prominent United kingdom lenders – including Lloyds Banking Class and you will Regal Financial off Scotland – within this 3 years.