The Virtual assistant financing program allows military and you will experts when you look at the Washington so you can purchase a property no downpayment or mortgage insurance policies. Those individuals are two persuasive advantages, particularly in pricier areas that require a substantial down percentage.

This method in addition to lets eligible borrowers to acquire different property models, in addition to isolated unmarried-relatives land, apartments, and you will townhouses.

However, there are some certain conditions in terms of to get a flat which have a beneficial Virtual assistant mortgage. To begin with, the fresh condominium invention have to have become in earlier times authorized by the You.S. Company out of Experts Items.

This article teaches you the new strategies just take when using a beneficial Virtual assistant financing to order an apartment inside the WA State.

Since you probably already know, this new Va mortgage program is limited to military players, veterans, and you may certain enduring partners. So in advance trying to find an apartment, you’ll want to obtain their Certificate out of Qualification on the Company away from Pros Situations.

It document verifies their qualification standing, giving the home loan company an eco-friendly white so you can originate and you may process the loan. You could potentially request their COE through the site or get lending company exercise for you.

2. Take a look at condominium development’s approval status.

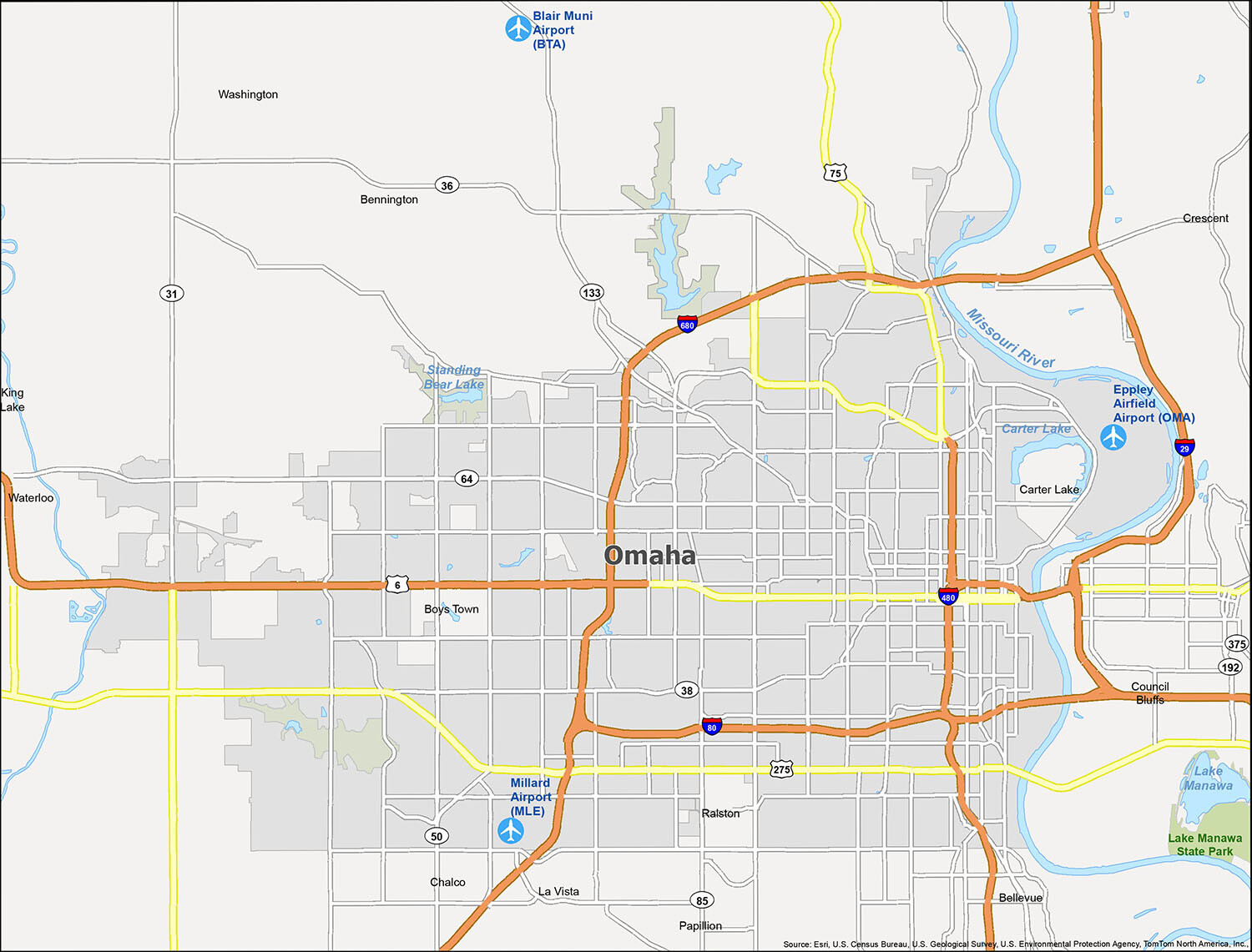

Of many condominium improvements over the condition regarding Washington currently accepted to have Virtual assistant loan incorporate. Yet not them. Very you should pull-up a summary of recognized condos in the certain town or state for which you intend to get a home.

Va retains a list of recognized apartments. In the event your condo is not into list, the project must be published to Virtual assistant getting remark to be certain this complies which have Va requirements.

- Visit the after the Website link:

- Look at the field getting recover merely recognized apartments

- Go into your state (at a minimum) plus the city or state

- Click on the submit option to procedure their demand

You will probably need to thin your pursuit if you possibly could, by giving a certain city otherwise county. For many who simply go into the state out-of Arizona, you will end up with a summary of more than dos,000 recognized condo advancements.

Note: In lieu of new FHA loan program, the new Va will not do spot approvals away from private condo equipment within an information. In order to be entitled to this option, the complete cutting-edge must be approved.

3. Comment the condo’s bylaws, dues, and you can special examination.

Ahead of diving headfirst on the condominium lifestyle having a beneficial Va financing (or one investment), do a little due diligence. This might save you headaches and money subsequently.

Start by reviewing the brand new condo development’s bylaws otherwise statutes to have residents. These may affect sets from decorate the balcony so you’re able to hosting events. Understanding these constraints initial ensures you might be at ease with the approach to life the latest condominium also provides.

You will also want to comment new association’s expenses and unique assessments. HOA fees shelter preferred city servicing and places, impacting your own month-to-month finances. Unique assessments, at the same time, try one to-time charges always funds major repairs.

cuatro. Get pre-approved by a home loan company.

The new condo holder/merchant is likely to accept the bring, if they see you’ve been economically pre-processed from the a lender. It reveals you’re a critical customer who can likely be recognized getting financing.

Pre-acceptance may also help you restrict their condominium record established on your own resource number. There’s absolutely no part of considering condo equipment you to definitely meet or exceed their restrict amount borrowed, unless you may come with the difference with your own money.

Once you’ve recognized a condo you want to buy (and you can verified its recognition standing), you could potentially submit a deal right to the seller. While you are dealing with a real estate agent, she or he may remark recent conversion process studies to choose a great bring matter.

You can take advantage of working with a real estate agent when to buy a condo for the Washington. Extremely experienced agents are extremely accustomed the newest Virtual assistant financing procedure for apartments. Your representative can also help your fill in a powerful offer, enhancing the options that it’ll end up being acknowledged.

6. Wait for the assessment and underwriting process.

All the services getting bought having an excellent Virtual assistant financing from inside the Washington State should be appraised to decide the current market worthy of and overall updates. That it applies to apartments too.

The borrowed funds financial have a tendency to demand the fresh assessment to be sure the condo may be worth exactly what you have wanted to pay for it. As a buyer, there’s not far for you to do in this processes, other than await their end.

The mortgage underwriter tend to feedback the latest assessment statement and all of almost every other documents to make sure conformity that have Virtual assistant financing guidance. They might as well as consult additional info from you, very be looking for the.

seven. Sit in closure, indication files, and get your keys!

In the event the underwriter is found that loan fits all of the relevant Virtual assistant condominium mortgage standards, you’ll end up happy to proceed to the brand new closure phase. That’s where your sign most of the signed files and you may shell out the settlement costs. Finally, you will receive the secrets to your brand new condominium!

Generally there you have it. These are the methods requisite when using an excellent Virtual assistant financing so you can purchase a condo during the WA State. Towards the correct a home and home loan class set up, providing and utilizing a good Va mortgage to order a http://www.clickcashadvance.com/payday-loans-il/augusta flat is getting a fairly smooth processes.

Has inquiries? On Sammamish Mortgage, we concentrate on new Va mortgage system and suffice consumers all across the state of Arizona. We can help you to get the mortgage procedure already been and you can boost your odds of providing Virtual assistant mortgage condo approval. Please call us if you would like to make use of an excellent Virtual assistant mortgage to purchase a condo, or you provides questions relating to the method.