Test thoroughly your envisioned framework loan requires before starting the loan application procedure. Mortgage conditions and you will down payment amounts differ with respect to the lender and created mortgage play with. Eg, finance designed for multi-equipment construction include so much more generous finance numbers but may want a lot more confirmation. Before you apply to have a property mortgage, look at the fuel of financial information, including your credit score and personal debt-to-income proportion. If possible, consult a monetary top-notch together with design and you will home experts to raised discover the options. A homes loan has the capacity to change your dream home with the possible.

Glimpse: Finest Build Loan companies

-

pop over to the web-site

- Ideal for Advanced Borrowing from the bank: U.S. Bank

- Perfect for Fair Credit: Wells Fargo

- Best for Bad credit: FMC Lending

- Good for Evaluating Loan providers: Domestic Build Mortgage loans

- Perfect for Low-down Repayments: Go Financial

- Good for On line The means to access: Normandy

- Quick look: Ideal Framework Loan companies

- 7 Best Design Loan companies

seven Top Framework Loan companies

Build loan lenders may help convenience the procedure of building your own finest household. Considercarefully what you are interested in into the financing and you can check out the choice you to definitely most useful work at your specific need. Instance, certain loans are designed for individuals with advanced credit ratings whenever you are anyone else take on lower down payments.

Ideal Complete: TD Lender

TD Bank has actually root you to definitely shadow back once again to the fresh new 1850s, broadening into an international peak for the sixties. Typically, TD Lender joined avenues and you can handled consumer needs because they came up. These types of requires ranged from this new economic products particularly handmade cards to help you money commercial a residential property improvements. TD Bank merged together with other creditors eg banking institutions and you may grew with the a major international powerhouse that’s ranked throughout the top ten premier banking institutions regarding twigs inside America.

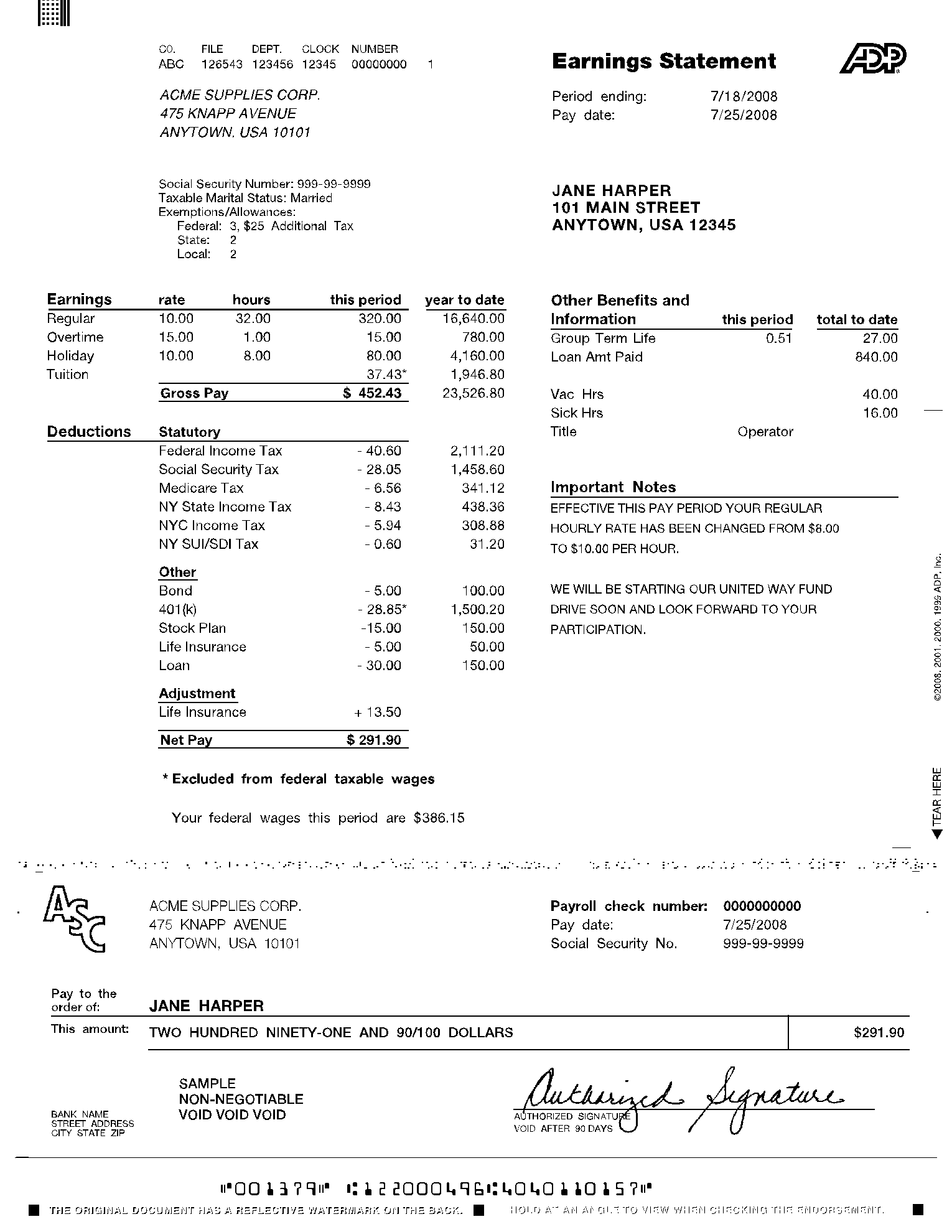

The firm will bring both industrial and private framework fund, evidencing thorough monetary fuel and you will an intense knowledge of customers means. The borrowed funds alternatives strive to defense each other the fresh new framework and you may family renovations. TD Bank even offers repaired and you may variable speed financing which have flexible off commission alternatives for a property-to-long lasting mortgage. A consideration in this sort of mortgage is that into the structure phase individuals generate attract-just repayments before house is ready to become stayed in. Given that residence is over and you will livable, the new debtor pays both interest while the dominating.

Mortgage terminology cover anything from drifting so you can repaired based on how a good debtor chooses to go ahead. Eg, consumers have the option so you can change a houses financing to the a financial. A downpayment of about 20% of the conversion price is demanded. Eg similar framework financing, repayments won’t be paid inside the a lump sum payment in in past times booked costs as the construction progresses. Your website even offers zero clearly mentioned lowest requirements to own credit scores otherwise pricing.

Before you apply for a financial loan, look at the numerous standards to own an effective TD Lender framework mortgage one to anyone is always to thoroughly comment when continuing for the a contract. The company demands information like your level of obligations, income and you can a finalized contract you to definitely relates to possibly the building otherwise buy. Suitable licenses will be required in advance of loan acceptance.

Good for Advanced level Borrowing: U.S. Lender

U.S. Financial was authored during the early 1860s possesses while the stretched to include a wide range of qualities to address private needs, riches administration, organization requires and you may corporate and you may industrial welfare. The organization was owned by its moms and dad company You.S. Bancorp, which is an openly exchanged organization. Typically, U.S. Financial provides integrated tech and covered changing buyers means if you are expanding their determine once the a financial organization.