Repaying the mortgage early is a type of financial objective getting of numerous people. The very thought of being financial-totally free was undoubtedly appealing, offering freedom out-of monthly obligations and liberty to use their earnings various other ways. But not, the choice to pay off the financial immediately isn’t usually straightforward and you will is based greatly in your larger economic objectives. Right here, we’ll explore the advantages and you will downsides out of very early mortgage repayment and explore alternative steps which may finest meet your requirements.

The key benefits of Settling Their Financial Very early

One of the main great things about paying your own home loan early ‘s the possibility to spend less on focus costs. The new offered you have got a home loan, the greater amount of attention it is possible to shell out over time. From the speeding up your repayments, you reduce the level of notice that accrues, possibly rescuing thousands of dollars along side longevity of the loan.

Are financial-100 % free will bring a quantity of economic liberty that can easily be extremely satisfying. Instead of a mortgage commission, you have so much more throw away income, which you can use to other intentions-whether or not which is reducing really works days, travel, committing to passions, or perhaps seeing a more comfortable lives.

For many, the mental benefit of purchasing their home downright is actually indispensable. Reducing debt can lessen stress and gives a feeling of coverage, specifically since you strategy advancing years and other existence goals.

In the event it May not Sound right to repay The Mortgage Early

Because great things about very early mortgage payment are unmistakeable, there are situations where it may not be the best financial disperse. Check out conditions in which keeping your mortgage might be advantageous:

When you yourself have a lot more dollars supplies, you could find top efficiency of the purchasing that cash rather than with these people to repay their mortgage. Particularly, committing to possessions, to order offers, otherwise to buy with the a business you can expect to provide a high get back for the money compared to desire coupons regarding paying their financial very early.

Paying down your mortgage ties up your money in your domestic, so it’s quicker accessible some other means or solutions. Such as, for many who found an inheritance otherwise good windfall, your first instinct is to repay the home loan. However, it could be so much more proper to hang on to that cash while however lowering your home loan appeal. Creating an offset account or rotating credit studio permits you to apply that money up against your own home loan harmony rather than in fact using off of the mortgage. In that way, you never shell out focus to the number, nevertheless continue to have entry to the money if needed.

The opportunity price of paying the financial early is an additional factor to consider. If your mortgage rate of interest is relatively lowest, you could find one investing your finances elsewhere also provides deeper output. Eg, if for example the mortgage speed was 3% you could potentially secure 6% or even more from the stock-exchange, it might make so much more feel to expend your money in lieu of utilizing it to repay the borrowed payday loans Kirk funds.

Strategies for Quickening Mortgage payment

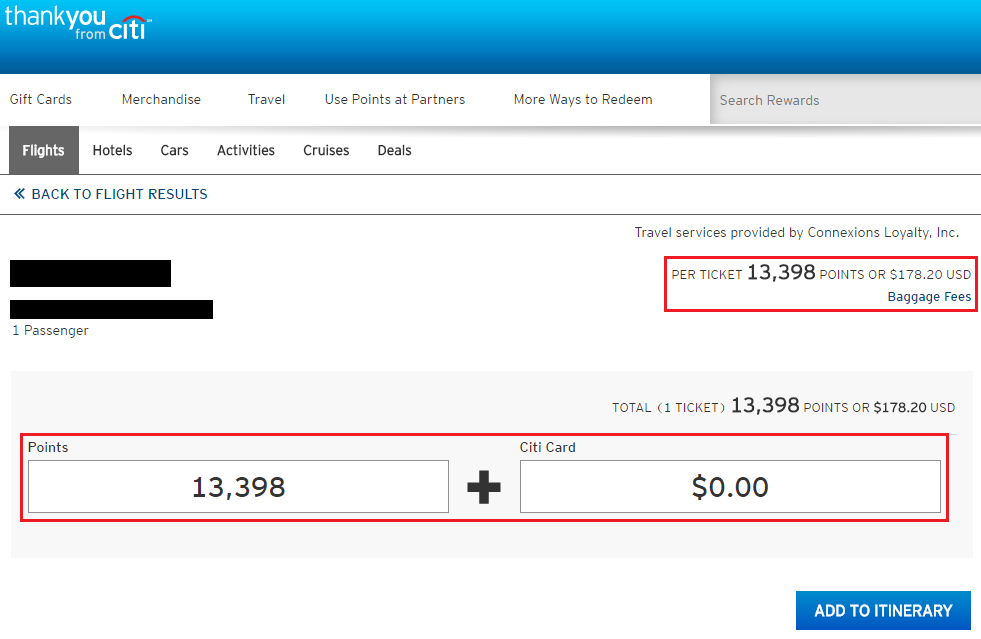

![]()

When you decide one settling their home loan very early is the right choice for you, there are several procedures you can use to help you speed the method:

Additional RepaymentsMaking additional costs is just one of the ideal an effective way to repay your own mortgage faster. Actually short more costs tends to make a change over the years, reducing the principal and you will, therefore, the degree of notice you can shell out.

Lump-Sum PaymentsIf you can get a plus, tax reimburse, or other windfall, believe putting it to your mortgage since the a swelling-contribution percentage. This may notably decrease your loan balance and shorten the mortgage name.

Growing Typical PaymentsIf your financial allowance allows, increasing your regular home loan repayments can be automate repayment. Even rounding your payments into the nearest hundred or so cash is shave age away from the mortgage.

Refinancing so you’re able to a smaller TermRefinancing to help you a shorter financing identity can also be as well as make it easier to pay the home loan easier. While this will get enhance your monthly premiums, it will save you a considerable amount in interest over the longevity of the loan.

Conclusion: What is Best for you?

The decision to pay back your home loan early is highly individual and you may hinges on your general financial requirements, newest condition, and you can upcoming preparations. If you’re very early installment could possibly offer extreme advantages, it is essential to consider these against the prospective great things about keeping your own mortgage and paying your finances someplace else.

Of these unsure concerning the best road give, seeking expert advice shall be indispensable. Within my Home loan, we could help you explore the choices, determine the money you owe, and produce a strategy that aligns along with your goals. Whether you are seeking to pay back the financial easily or explore solution investment options, we’re here to aid.

To possess personalised guidance, call us at my Mortgage. Our company is ready to help you in making the finest monetary behavior for your future.