While preparing to start household-hunting, verify you might be financially willing to close on household out of your hopes and dreams. Begin by the creditworthiness. What is a good credit score to acquire an alternative home when you look at the 2024?

To shop for a home might be a complicated processes, this helps to ready yourself if you can one which just start. This can include ensuring that you are economically stable enough to neck which the brand new responsibility. While it does not give a complete picture of debt health, your credit rating is an excellent signal of ability to create currency. The better the new get, the greater amount of creditworthy you look so you’re able to loan providers, additionally the simpler it could be to secure a loan.

Very, what’s good credit? And exactly how do you really increase your personal to get it in which it needs to be into mortgage need? Take time today to better discover credit score, the way they perception their homebuying feel, and you will you skill to maximize your rating.

What is a credit history?

Your credit score try several that displays a loan provider just how likely you are to invest back that loan timely. The new get selections regarding 350 so you can 800. The higher the fresh rating, the better your credit prospective.

The brand new get hinges on a card bureau, that is a friends you to accumulates and you can assesses credit guidance, as well as mortgage amounts, percentage record, personal debt and available borrowing from the bank. Experian, Equifax, and Transunion would be the around three head credit bureaus. Lenders will get rely on one, two, otherwise all about three enterprises to get its investigation in making financing conclusion. Credit bureaus was regulated because of the Reasonable Credit reporting Work payday loans Tennessee, and this governs the details they are permitted to collect and you will share.

Your credit score may differ from 1 credit agency on second, from the study they collect as well as how they weigh it to decide your own score. In addition, credit file often incorporate errors. It is vital to look at most of the three.

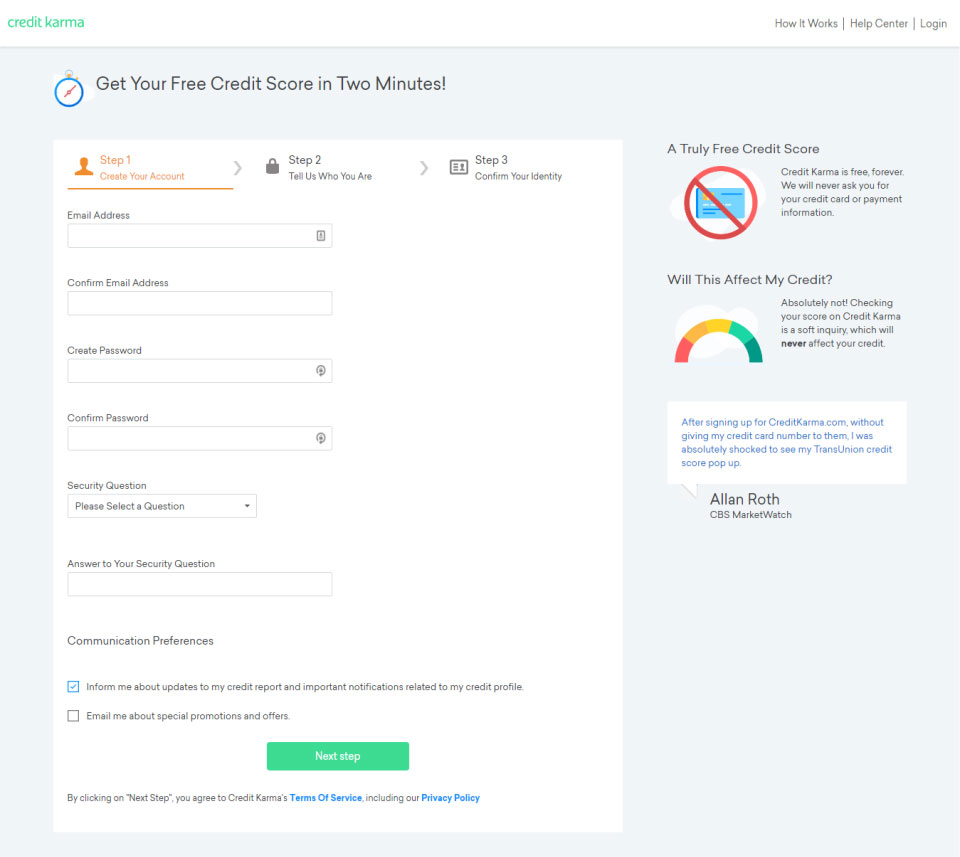

But Wait! Before you hurry off to check your credit rating, end up being informed you to definitely any query you certainly will adversely effect the get. Credit reporting agencies dont always distinguish issues because coming from the consumer or a lender. They might view all of them once the an alternative loan request, which will decrease your credit history. Although not, you can aquire a free of charge credit report in the place of damaging their borrowing rating, one time per year, at the FreeCreditReport.

Just how try my credit history computed?

Businesses have fun with a formula entitled a rating design to determine the credit rating. There are many different things that define a regular credit rating. These include:

- Your existing amount of delinquent personal debt

- Their costs-using record

- The quantity and you will sort of loan profile you’ve got discover

- Just how long those people levels have been unlock

- The borrowing from the bank application ratio, which is simply how much of your credit you may be currently using

- Loan issues, that are the brand new borrowing apps you’ve done which have started an effective financial contacting a cards bureau

- An auto loan

- A consumer loan

- A charge card

- An alternative borrowing tool

Trying to get lenders should be a daunting process. It can be way more difficult when your credit score isn’t really where you would like it to be. Although this is not the just facet of debt records one a lender can look on, it’s a significant one.

Very first, rest assured that the get doesn’t need to getting perfect. You could potentially qualify for a mortgage regardless of if you are nonetheless trying to develop your credit rating. However, lenders will usually provide greatest terms and conditions and you may interest rates to individuals that have large scores.