The most important element of qualifying to own an excellent Chattel Mortgage try the second details about the house: Make of your house, Make of Household, 12 months out-of Family, Just how much this new Package Book Try and get Speed. Particularly, land situated prior to 1976 cannot qualify unless compensating situations can be found.

5. Assets Valuation

Really homes shielded by the an effective Chattel Loan none of them an enthusiastic appraisal. Although some will get, more well-known station from choosing the value of a made house toward hired property is by using DataComp. DataComp will bring a type of assessment valuation that excludes the significance of your property.

Because of the talking-to a home loan professional and achieving https://speedycashloan.net/loans/100-dollar-payday-loan/ proper believed inside the place, the majority of people could work to settle a position to help you meet the requirements getting a great Chattel Financial.

Advantages of choosing a great Chattel Loan

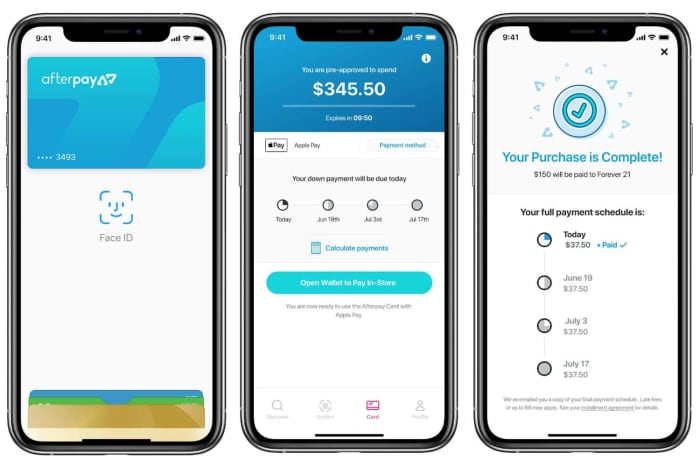

One of the most significant advantages of choosing a chattel home loan so you can funds a made household for the rented property is that it does getting simpler to qualify for than simply a traditional home loan. It is because chattel funds, or are created lenders, are usually according to research by the worth of the home rather than your credit score otherwise income.

A separate advantageous asset of having fun with an effective chattel financing would be the fact it could be recommended if you plan to go the home subsequently. Due to the fact residence is believed personal possessions, it could be more straightforward to promote otherwise disperse than property which is connected with a permanent foundation.

If you are rates was high toward an effective chattel home loan in comparison in order to a classic financial, rates of interest try far lower with the good chattel mortgage in comparison so you can your own (unsecured) financing. This makes it the lowest priced provider getting resource property inside the a residential district otherwise playground having parcel charge.

Chattel Mortgage Downsides

While there are a few advantages to using a chattel mortgage, there are even particular cons to look at. One of many drawbacks would be the fact chattel finance usually started with higher interest rates than antique mortgages. This may improve financing more expensive finally, specifically if you intend to keep the household for a long go out.

A new disadvantage of utilizing good chattel mortgage is the fact that loan name is typically quicker than just a traditional mortgage. Thus you are going to need to generate high monthly payments from inside the order to repay the mortgage inside a smaller number of date. The most famous term is actually a great 20 year otherwise a 25 12 months financial.

Obtaining an effective Chattel Loan Washington

If you are looking locate a made home loan otherwise mobile mortgage for the Arizona, the process to have getting good chattel mortgage is similar to that away from almost every other states. As previously mentioned, the first step is to try to over a loan application and gives particular original data on lender.

After you’ve understood the house and you may recorded the job and you can records, the financial institution will begin this new certification techniques. This will usually encompass examining your credit report, money, and you may work status, along with conducting an appraisal of the home to choose the worthy of.

You to definitely prospective advantageous asset of obtaining a great chattel mortgage for a manufactured domestic or cellular house when you look at the Washington is the fact that the procedure could possibly get become convenient than simply that a traditional mortgage. It is because smaller documents is typically necessary, in addition to lender are far more willing to help you for those who have less-than-finest borrowing from the bank.

Although not, it’s important to remember that chattel finance to own are made belongings otherwise mobile property come with highest interest levels and you may less cost words than simply traditional mortgages. As a result, it is important to cautiously think about your choices and you may comparison shop to own an educated mortgage terminology in advance of investing in a made mortgage inside the Washington or any other state.