HomePath Features

HomePath properties is homes that are belonging to Fannie mae. Anybody can purchase a great HomePath property. HomePath real estate loan apps that are traditional mortgages needed zero appraisals with no private home loan insurance coverage. HomePath Mortgage loan Applications got left behind by Federal national mortgage association.

HomePath services have deferred restoration if the buyers are purchasing the property. HomePath loans used to be available for owner-occupied single-friends homes, second/trips land, and you may investment land. Homebuyers can find a HomePath possessions via most other mortgage software instance FHA loan software, Virtual assistant mortgage software, and you may traditional antique mortgage programs.

Even though homebuyers score an assessment which had been appreciated from the the cost does not always mean one to everything is alright. Lenders have an assessment review agencies in which the appraisal becomes examined from the an in-family underwriter.

That it quality control level was brought to ensure that what you to your the fresh appraisal declaration try warranted to guard the latest lender’s security. Oftentimes, new assessment remark happens smoothly and is also only an issue out of formality. Regrettably, there are times when brand new lender’s appraisal remark department cannot concur with the assessment.

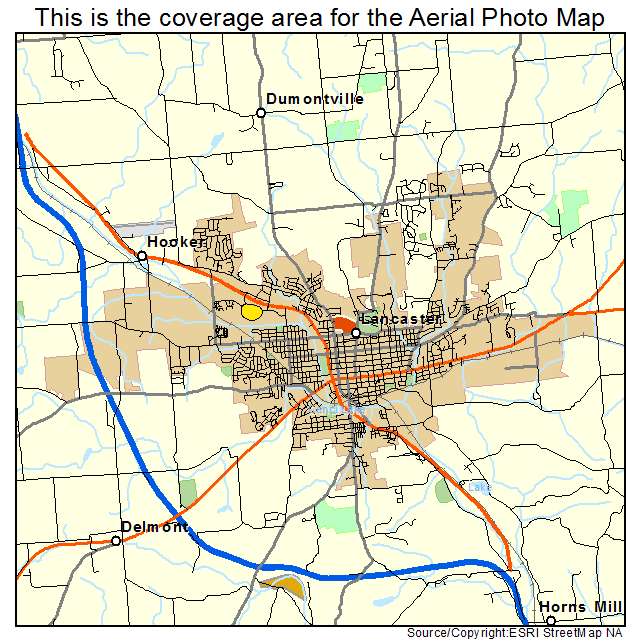

Should this be the fact, the lender commands an extra appraisal. Like, if your equivalent transformation listed on the domestic assessment commonly inside a-one square mile radius, the appraisal feedback underwriter could possibly get question you to definitely. I experienced a recent instance where in fact the topic assets are for the four contiguous plenty.

The fresh new appraiser must go 4 miles locate equivalent sales. In this case, the financial institution requested the next appraisal and you will that which you made an appearance ok. There are many times when the brand new appraisal will come in in the price well worth however the internal appraisal review underwriter doesn’t agree with the benefits minimizing the benefits.

There are lenders that are notorious getting slashing the new assessment worth to less well worth. Simply because they don’t really agree with the appraiser and you may the purchase price. Homeowners who need so you can be eligible for a home loan with a lender and no mortgage overlays is also call us within Gustan Cho Partners on 800-900-8569 or text us to possess a faster reaction. Otherwise individuals can be email all of us from the Gustan Cho Associates does not have any overlays towards the FHA, Va, USDA, and you will Conventional financing. Get answer for aprraisal points from your masters, contact us

Faq’s Throughout the Appraisal Issues Throughout Real estate and Financial Procedure

1. What is actually property appraisal, and why would it be crucial that you loan providers? A property appraisal is actually a home valuation conducted from the an authorized appraiser. Lenders require appraisals to evaluate the fresh property’s really worth, that is collateral to your mortgage. That it valuation assists lenders regulate how much they are prepared to provide in line with the property’s value.

dos. Why does the assessment processes really works pursuing the 2008 home freeze? After the 2008 real estate crash, more strict assistance had been accompanied to stop overestimated home prices. Appraisers must now conform to guidelines put of the HUD, specifically for FHA and you may Virtual assistant appraisals. It guarantees a whole lot more right valuations and you will protects one another borrowers and you can loan providers.

3. What does the latest assessment pertain to the loan? Appraisals is inbuilt towards the home loan processes while they help loan providers assess risk and find out mortgage conditions. New appraised worthy of has an effect on the loan-to-well worth proportion, interest levels, and also the dependence on personal home loan insurance coverage. Simultaneously, appraisals are essential to have underwriting choices and you will manage consumers out of overpaying to possess services.

cuatro. Just how is appraisals ordered and you may held? Appraisals are generally bought due to an assessment Government Providers (AMC). Immediately after purchased, a licensed appraiser schedules a check of the home. The newest appraisal declaration is frequently gotten in this 7 days. The lending company personal loans online Wisconsin after that evaluations the latest report to make certain precision and may request changes.