- Slide into the household earnings constraints of the state

- The house we want to buy features an effective $224,five-hundred statewide cover

- Minimum credit rating off 640 otherwise 660 with regards to the household method of

The brand new Step of progress Michigan system is additionally known as the Toughest Struck Finance, and it will assist homebuyers get caught up on their mortgage repayments, assets taxes, or various charge. This option try federally financed from the state away from Michigan. You can get around $31,000 inside the help help you hold control of your house. Providing you stay in our home as your primary residence, it mortgage try forgivable for a price from 20% each year. A few qualification conditions is actually:

- You’ve got evidence you could potentially maintain your money immediately following you happen to be stuck upwards

- You’re a prey out-of involuntary delinquency. Such, out of medical costs, divorce case, otherwise employment losings

Ton Insurance coverage

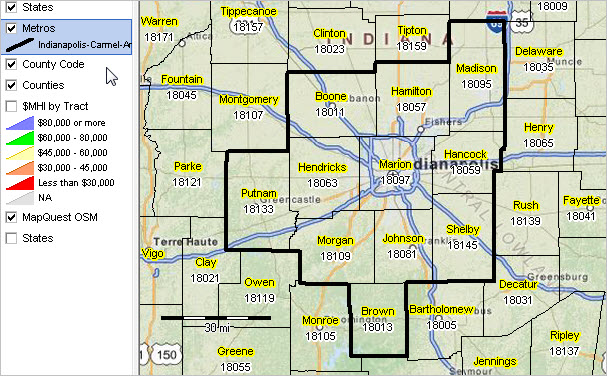

Homeowner’s insurance policies normally do not coverage ton. Most of the county out-of Michigan is recognized as getting a beneficial very low ton chance. Areas having elevated chance pages are as follows.

- reasonable chance: Department, Calhoun, Cass, Ingham, Lapeer, Livingston, Mecosta, Midland, Muskegon, Oceana, Ottawa, Saint Joseph, Wayne

- modest chance: Barry, Bay, Clinton, Eaton, Ionia, Isabella, Jackson, Shiawassee, Tuscola

- high-risk: Monroe, Saint Clair

Home buyers having mortgages in highest-exposure elements have to pick flood insurance policies. Very flood insurance coverage can be bought by All of us federal authorities from Federal Flood Insurance rates Program. Under-cost flooding insurance policies inside the higher-risk portion try to be a subsidy so you can rich homeowners.

The NFIP will not fees almost sufficient to cover this new questioned will cost you of the liabilities. The fresh examination are not adequate to make people buffer to pay for a remarkable year, such just what happened that have Hurricane Katrina for the 2005 or Hurricane Exotic when you look at the 2012. As property owners do not sustain the full price of building from inside the a good ton region we get significantly more property here than just when the homeowners incurred an entire cost of the new flood risk, and that aggravate this new government’s will cost you next disaster.

Residents who happen to live for the lower chance portion & aren’t required to purchase flooding insurance policies greatly mix-subsidize people who will be into the areas where flooding much more prominent.

Hail destroy is normal along side east edge of the state. Destroy regarding hail is normally covered by home insurance policies.

Property Taxation

Michigan’s taxation weight keeps , Michigan’s for each and every capita taxation load was beneath the national mediocre. During the 2014 this new tax burden during the Michigan is actually $900, which metropolitan areas it 19% underneath the national average. Once you have a look at each other local and you can county taxation since the a great percentage of personal income, Michigan was once more underneath the national average of 16%.

Other A home Legislation

Michigan enjoys a detrimental property rules, which law means somebody can be transfer to property, uses a few easy steps, to get this new name to that house. The individual have to begin 800 loan over 2 years this course of action by the getting into a clear or quit property. They want to individual it property and you may a general public and you will transparent ways, and then make they clear which they inhabit the dwelling. The newest resident have to and then make advancements to your assets and manage to confirm all of the improvements these are generally and then make. When you look at the Michigan, new renter need to do which to own a time period of fifteen years prior to they could allege the new term with the possessions and legitimately have it.

For the 1993, Michigan taxpayers demanded an easy way to convenience their monetary burdens. They broke up the house toward two areas known as a good homestead and low-homestead. The latest homestead property is a good homeowner’s number one residence, and you may a low-homestead is a corporate otherwise rental property. Up until the rules, assets taxes you will boost based on the property’s county equalized really worth, and this refers to fifty% of your own dollars worth of the property. Proposal A made use of a limit how far assets fees you will definitely upsurge in one year. After that suggestion enacted, possessions taxes cannot increase more 5% or the rate regarding rising prices in any 12 months months. On top of that, it additional $0.02 towards the condition transformation taxation too.