Reaganomics and Reduction of the Black Market

A good broker will provide the necessary tools, resources, and support to help you understand the risks and opportunities associated with leverage trading. Spread trading must be done in a margin account. Exiting with a stop loss and a losing trade is still good trading if it falls within your trading plan’s rules. I write content to help you secure clients, stand out, and scale up • LinkedIn ghostwriter and personal brand strategist for consultants, coaches, and founders. We are thrilled to announce our exciting partnership with TradingView, a leading platform in the world of financial analysis and trading. If you want to trade in the share market, you should have a good grasp of the fundamentals of the meaning of trading. The placement of contingent orders by you or broker, or trading advisor, such as a « stop loss » or « stop limit » order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. This can be achieved through Plus500’s daily News and Market Insights articles. Traders must constantly monitor multiple data streams, interpret complex market signals, and execute trades with precision timing. The upside is that your losses will offset any gains. EQUITY AND LIABILITIES. According to the Securities Contracts Regulation Act SCRA of 1956, dabba trading is a criminal offence under Section 231. Correct and Rewrite the following statement. As a digital marketer could step in to run small social advertising or search engine marketing campaigns. A trading plan is a comprehensive decision making tool you can use to help you work towards your goals. Your maximum risk is the premium you pay to open. Learning the complexities of options, let alone any financial instrument, can be a cumbersome task. You will find all the necessary columns already present in the format. Other types of charts you will encounter in the market are bar charts, step lines, histograms, circles, renko, and columns among others. Which is earlier than the official intraday time in India. Volatile stocks are targeted in such cases, and procured shares are sold off as soon as a massive movement in prices is witnessed. Sleep patterns and trading psychology share a deep connection, since the tension and worry associated with trading often encroach upon peaceful slumber. 9 period or 20 period are popular among scalp traders, while day traders may use longer term moving averages e. Key Stories from the past week: Markets rebound as the US Dollar weakens. This way, there is no transfer of ownership of shares. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Mastering day trading patterns is a fundamental aspect of achieving success in the fast paced world of day trading.

How to Learn Trading: A Step by Step Guide for Beginners

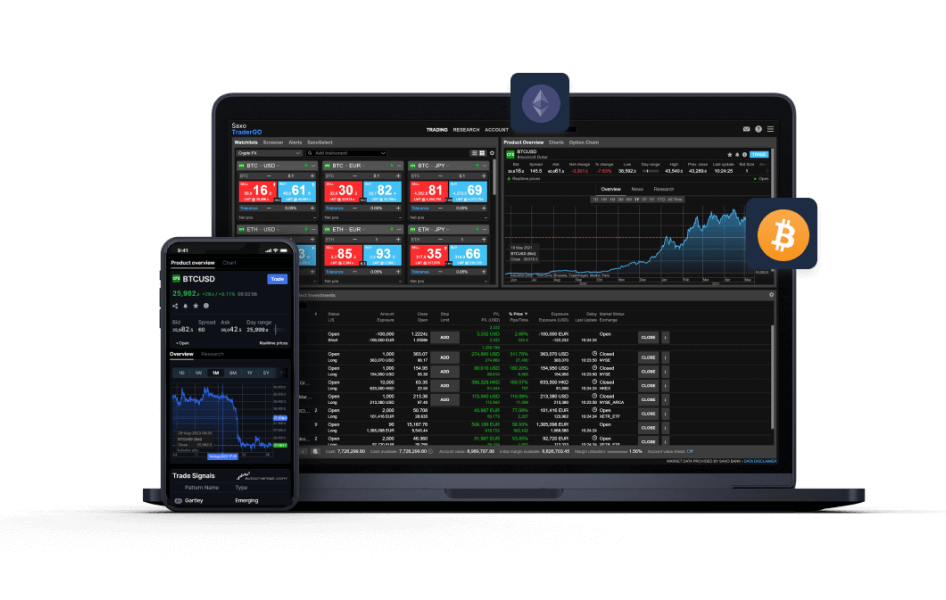

Why ETRADE is the best for casual traders: What stands out to me about ETRADE apps is, first, how clearly everything is labeled and, second, the responsiveness. Dog walking or grooming are popular but there are other opportunities, such as caring for pets in their home when owners are away on holiday. HIGH RISK INVESTMENT WARNING: Trading CFDs is highly speculative, involves significant risk of loss and is not suitable for all investors. Before quitting trading, let’s give it one more try. You’ll also have access to the more advanced StreetSmart Mobile. The best paper trading platforms in India include TradingView, Moneybhai, Neostox, Zerodha Kite, Sensibull, NSE paathshala, Investopedia simulator, Chartlink, and Frontpage. 5+ Million happy customers, 20000+ CAs and tax experts and 10000+ businesses across India. Using algomojo you can reduce human intervention. However, with 15 seconds remaining in the formation of the candle, selling pressure returns. Any hint of illegal activity is an immediate, irrevocable ban worthy offense. Your Mobile number and Email id will not be published. SoFi’s stock trading app caters to a broad audience of investors by offering both taxable and retirement brokerage accounts. Except, you set it up, and decide which pension provider you want the pension company who manages it. But you will experience investing differently when you have real money at risk. However, the best parameters historically are unlikely to be the best ones going forward, and if you position size according to overly optimistic backtests, that could in catastrophe. Bajaj Financial Securities Limited is engaged in the business of Stock Broking and as a Depository Participant. Open Account Instantly. Join thousands of traders and trade CFDs on forex, shares, indices, commodities, and cryptocurrencies.

How to start trading online

That said, the core job of a forex broker is to allow you to buy and sell currency pairs. A good approach to day trading for beginners is. When the upper band is breached, options traders may consider buying a Put option or shorting a Call option. Really loved the podcast and Thanks to the customer success team for navigating me through the App. Understanding psychology can be key to learning the way decisions are made. I’m not an expert when it comes to brokerages and investment accounts, and I know a lot https://go-pocket-option.bond/login/ of people are just like me. Therefore, when you are selecting stocks for intraday trading, traders can use a trendline for early entry into the next price wave in the direction of the trend. EToro: Trade and Invest. This analysis will help you determine where you can concentrate your cost reduction efforts. Residents are subject to country specific restrictions. Desmond is incredibly passionate about helping people become better traders working closely with Axi to produce educational videos, quizzes, e books, indicators, and market research to help traders take their game to the next level.

To switch to a cash account

Here are some commonly used ones. The possibility exists that you could sustain a loss of some or all of your initial investment and, therefore, you should not invest money you cannot afford to lose. Some may earn a substantial income, while others may not be as successful. Cookies from third parties which may be used for personalization and determining your location. Bajaj Financial Securities Limited has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No. You can earn a lot of money and easily manage your daily expenses through this. As prices tend to appreciate during these market conditions, it’s easier to buy a security and experience a profit a short while later. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. As you see, there are so many candlestick patterns that you can use in the market. Automation is one of the key features that you will notice in the Vyapar accounting app. I never really understood what people meant by that. These expenses are deducted from the profit or are added to gross loss and the resulting value thus obtained will be net profit or net loss. Below is a list of the most common types of options expirations. Algorithmic trading, or algo trading, is when a computer is given a script or code called a trading strategy, that is executed for you. Clients: Help and Support. Losses can exceed deposits. According to experts the time frame between 9. The same is then directed to the stock exchanges. Success mantra: This type of stock trading works well when the stock is either rising or falling and is ineffective during sideways movements. Paper trading is not only useful for new traders but also valuable for experienced investors. Similar to what we discussed above, this informs the chart reader that both bears and bulls created a tug of war while this candle was forming, and neither really won, despite the candle closing green or red. The three inside down candlestick pattern is a bearish reversal pattern which is formed at the top of the price chart. Tick charts assist day traders in identifying successful market opportunities by displaying precise real time price movements that depend on the number of trades. Typically, these entities prefer a « T shaped form » for compiling their profit and loss statements. No consumer protection. Display up to 20 simultaneous charts across one or several monitors. In depth market research is also crucial, so tools and data analysis are important features to consider. This helps limit losses on any given trade. Scalping is based on the assumption that most stocks will complete the first stage of a movement but where it goes from there is uncertain.

1 Identify the downtrend

Use limited data to select advertising. This website is owned and operated by Hantec Markets Holdings Limited. As trading technology continues to advance, so too does the interest in algorithmic trading. The new Dynamic Trading tool allows you to place multiple trades simultaneously, which was a nice innovation by CMC Markets this year. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. To enter the share market as a trader or an investor, you must open a demat or a brokerage account. However, if a strong trend is present, a correction or rally will not necessarily ensue. News provides most of the opportunities. Securities and Exchange Commission. Fluctuations of the underlying stock have no impact. You can update your choices at any time in your settings. Some forex traders ensure they’ve closed out of their positions before the end of their own trading day to avoid the risk of losses due to the net financing rate. Contact us to learn how to port your algorithms. In fact, you could almost trade without candles using this chart pattern, though we don’t recommend doing that. Sharp drops and increases of the price will be displayed as one large candle, even if you choose a rather small view like 1 minute. I would like to know what y’all do. Groww adopts a straightforward flat fee pricing model for its services.

02 Fraction

They must sell these options contracts within the expiration date to earn profits or avoid steep losses. Cohen breaks down each strategy in detail, explaining how and when to use them. Deputy Investing Editor. To avoid forex scams, you should only use regulated banks and brokers that are properly licensed to offer forex trading services in your country of residence. When trading with leverage, you don’t need to pay the full value of your trade upfront. The different types, strategies, and risks. It is also used to identify the momentum of the trend. In case you feel that Plus500 is suitable for you, you can learn how to use our Trading Platform through Plus500’s Trader’s Guide video on « How to Trade with Plus500. 05 for stocks with a market capitalization of less than Rs. So, it is possible that the opening price on a Sunday evening will be different from the closing price on the previous Friday night – resulting in a gap. On the other hand, Swan Bitcoin is a company that is 100% focused on the Bitcoin mission, and as such they provide a lot of educational materials and even a popular podcast, so if you are only interested in Bitcoin this is a good option for you.

A/C opening Charges

Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol’s Algorithmic Trading Definition Language FIXatdl, which allows firms receiving orders to specify exactly how their electronic orders should be expressed. If the price of a share goes up from $100 to $105, the value of the derivative will increase by the same amount. Out of the nine individuals, seven including Rakesh and his wife Rekha Jhunjhunwala had settled the proceedings with Sebi on July 14, 2021. They do not trade actively, with most placing fewer than 10 trades in a year. You’ll benefit from tax advantages now, investment growth later and your money is still accessible to you. Careful and proper head and shoulder pattern also tends to work well only when plotted properly, so daytraders focus on this potential trend reversal pattern and use these patterns to identify momentum shifts and execute multiple trades in a single day. We’ll break down the essential concepts and guide you through the most critical steps, from choosing a broker and placing your first trade to developing a solid strategy and, most importantly, managing your risk. Focusing on these factors will help you choose a forex broker in the UK that aligns with your trading needs, ensures a secure environment, and provides a smooth and efficient trading experience. Forex trading works like any other transaction where you are buying one asset using a currency. A cryptocurrency exchange is a digital marketplace where traders can buy, sell, and exchange various cryptocurrencies. Keep adding more to the platform, you’re doing a great job. The registered office of Exness SC LTD is at 9A, CT House, 2nd Floor, Providence, Mahe, Seychelles. To limit risk, brokers use access control systems to restrict traders from executing certain options strategies that would not be suitable for them. However, a day trader with the legal minimum of $25,000 in their account can buy $100,000 4× leverage worth of stock during the day, as long as half of those positions are exited before the market close. They were not traded in secondary markets. Read Also: A Complete Guide on How to Open Trading Account. I find the IG Trading app to be easy to use and jam packed with powerful features and intuitive trading tools. To determine the best approach for your specific investment goals, speaking with a reputable fiduciary investment advisor is recommended. Starting Cost: ₹5 15 lakhs to buy smart home devices, set up installation services, and for marketing. The objective of position trading is to profit from major trends in the market rather than short term price movements. A simple to use platform. The head and shoulders chart pattern and the triangle chart pattern are two of the most common patterns for forex traders. If you spread bet or trade CFDs on equities, then losses, amplified by the leverage associated with these products, can have a significant impact on capital.

Investment vehicles

We’re here 24 hours a day, except from 6am to 4pm on Saturday UTC+8. Find out what makes them tick, their huge failures and how they finally got to where they are now. Should you choose to invest through this website or with any of the international VT Markets entities, you will be subject to the rules and regulations of the relevant overseas regulatory authorities, not the FCA. Get our latest insights and announcements delivered straight to your inbox with The Real Trader newsletter. It is also known as « inventory » and is shown on the credit side of a trading account. Unlike fundamental traders, noise traders may react intuitively to news headlines, rumors, or market sentiment. Similar to traditional stock exchanges, these platforms make it easy for users to trade digital currencies like Bitcoin, Ethereum, and many others. 64% of retail investor accounts lose money when trading CFDs with this provider. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Next, a larger bullish candle forms, completely engulfing the bearish candle. NerdWallet™ 55 Hawthorne St. You might buy some stocks today, and sell them by the end of the week, or the end of the month, hopefully for a profit. So your win rate for the month was 30% – which would equate to an unprofitable month according to conventional wisdom. 5paisa has a well designed mobile trading app combining all the salient features. Staking or rewards program: Yes. There’s a lot of platform that offers those options standard.

Market Snapshot

As you do so, continuously review your trades and check them against your learning resources to adjust your strategy. Options are considered derivatives because they derive their value from the price of another asset, called the underlying asset. So we will look for bearish crossovers in the direction of the trend, as highlighted below. Grab your 14 day StocksToTrade trial today — it’s only $7. Position trading can be suitable for beginners who prefer a less time intensive trading approach and have a long term investment mindset. Other than the margin, you also pay a spread, which is the difference between the ‘buy’ and the ‘sell’ price of an asset. These are wise words to live by if you’re new to the stock market and wondering if trading is right for you. The Impact app focuses on ESG environmental, social and governance investing. State whether the following statement is True or False with reasons. 23 per share, or $123 per contract, for a total cost of $1,230. The basic strategy of trading the news is to buy a stock which has just announced good news, or short sell on bad news. Hi Mark, Bitcoin Evolution is pretty much a sure way to lose money, and as close as you can get to being a scam without being one outright. Additional terms may apply to free offers. Some stock trading apps also utilise biometric identification and many of the providers listed above are covered by the Financial Services Compensation Scheme, which means your account balance is protected up to the sum of £85,000 should the provider go out of business. Use the broker comparison tool to compare over 150 different account features and fees. It’s a common reference point for discussing stock market movements or trends during specific time intervals. 83% interest on a $10,000 margin loan balance, while Lite clients pay 7. That was the last blow I could take and so I tried contacting him. It’s also unlikely that anyone learns directly from their local day trader.

Market Data Home

To keep learning and advancing your career, the following resources will be helpful. However, it also carries significant risks: it’s reliant on complex technology that can malfunction or be hacked, and high frequency trading can amplify systemic risk. In today’s era of markets, the potential of manipulation has thereby increased. The CBOE offers options trading on various underlying securities including market indexes, exchange traded funds ETFs, stocks, and volatility indexes. For instance, Webull’s platform offers a far more robust trading experience that includes advanced technical charting capabilities, available quantitative studies, deep market news, fundamental comparison tools, excellent customization, and broad options trading features. This means your profits can be magnified – as can your losses, if you’re selling options. The height of the pattern can provide insight into how far the trend may continue after a breakout occurs. By Sivakumar Jayachandran. Not all brokers provide you with the same set of investment options. Our reviews were conducted using the following devices: iPhone 12 Pro, iPhone 15 Pro Max, MacBook Pro M1 with 8 GB RAM running the current MacOS, and a Dell Vostro 5402 laptop i5 with 8 GB RAM running Windows 11 Pro. This mobile tool is powerful enough that you can use it to develop and execute a complex trading strategy while on the move. Bajaj Financial Securities Limited « Bajaj Broking » or « Research Entity » is regulated by the Securities and Exchange Board of India « SEBI » and is licensed to carry on the business of broking, depository services and related activities. Reach out to us, we’d love to start a dialogue with you. Manage your strategies on the go with the Capitalise. If you’re looking to trade options, the good news is that it often doesn’t take a lot of money to get started. Between the two brokers, Schwab has the edge for educational resources and trading tools. They form as prices consolidate in an unusually tight trading range after a large advance or decline. Read More Does Algorithmic Trading Work. Paul Robinson, DailyFX currency analyst. If you’re a long term investor, your focus may be the bigger picture—the larger market trends and cycles, such as bull and bear markets. Don’t invest more than a fraction of your trading capital at once, and keep a trading journal noting why you entered and exited each trade and how well that trade performed. Fidelity offers a variety of account types outside of normal taxable investment accounts, like you find at Robinhood. And Hong Kong stocks and ETFs with a $0 commission on Hong Kong trades. Scalping in this sense is the practice of purchasing a security for one’s own account shortly before recommending that security for investment and then shortly thereafter selling the security at a profit upon the rise in the market price following the recommendation. Once you click on Deploy button, Tradetron reply’s you with this message. You would like to settle your trade for a profit of ₹1000 for the day. One standout feature is its virtual trading platform, which allows you to practice your trading skills in a risk free environment. This report does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

NSE NMFII

In the transaction, the premium also plays a role as it enhances the break even point. This advanced tool provides deep insights into the market dynamics inclu. CS dont care when you raise these complaints and the forum has so many bots that give fake positive reviews of every change that you cant be heard. Foreign exchange forex or FX trading involves buying one currency and selling another while attempting to profit from the trade. It may sound cliche, and we are not one to tell you to stop « learning, » per se, but less is usually more. Low market activity causes bars to build more slowly, allowing traders to examine quieter intervals and locate accurate entry and exit positions for their transactions. A beginner’s guide: What is trading and how does it work. This note discusses the insider trading provisions of the Canada Business Corporations Act CBCA. Intraday trading, also called day trading, is the practice of buying and selling stocks on the same day. Elliot Wave Theory EWT is a popular method of technical analysis that helps traders predict. Launched in 2017, Paytm Money has experienced rapid growth and is recognized for its minimal brokerage fees. Trading with the power of margin allows you to maximise your potential for returns. Less than or equal to Rs. Notably, the TV sets don’t need to be extremely expensive.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success

The symmetrical triangle pattern typically signifies a period of indecision in the market, with buyers and sellers in equilibrium and the asset price experiencing a period of consolidation. 03 per contract to cover regulatory fees makes this offer all the more alluring. Our platform also offers technical indicators and a Reuters news feed – plus, you can use IG Academy, expert webinars and seminars, and more to learn about trading or to build on your skills. Typically, basic features are free, with advanced features available through paid plans. $0, $5 minimum per fractional share transaction. One thing to note is that scalping requires discipline. MFCI is a Canadian securities broker specializing in Order Execution Only OEO services. Every country has its own stock exchange organised market, where shares of listed companies are bought and sold. The Debt comes in the form of bond issues or loans, while the equity which may come in the form of common stock, preferred stock, or in the form of retained earnings. For example, no matter whether the trade is of just one contract, or 100,000 shares, each trade counts once. Steven has served as a registered commodity futures representative for domestic and internationally regulated brokerages and holds a Series III license in the US as a Commodity Trading Advisor CTA. Earmark funds you can trade with and are prepared to lose. Credit card products are offered by Robinhood Credit, Inc. In addition to its floor based open outcry trading, the CBOE also operates an all electronic trading platform. While this example illustrates how leveraged trading can increase your profits, it also demonstrates how it can have a devastating impact on your portfolio, particularly if you choose to take on higher leveraging. Get all of your passes, tickets, cards, and more in one place. Quick and exceptional forex trading execution. Market conditions may also be inaccurately simulated without nuances like order delays, liquidity constraints etc. In the area marked with the letter A there is a chart that could be described as a morning star. Investors have years to develop and hone their skills, and strategies used 20 years ago are still utilized today. Minimum spreads, average spreads, margin rates. Global oil benchmark Brent crude climbed 0. Although the forex market is closed to speculative trading over the weekend, the market is still open to central banks https://go-pocket-option.bond/ and related organisations. Any disputes regarding delivery, services, suitability, merchantability, availability or quality of the offer and / or products / services under the offer must be addressed in writing, by the customer directly to respective merchants and ICICI Securities will not entertain any communications in this regard. Earnings per equity share for discontinued operation. You purchase one call option with a strike price of $115 for one month in the future for 37 cents per contract.