- Debt relief: When you settle an obligations, the collector otherwise collector agrees in order to forgive they in return for less money than you actually are obligated to pay. Everything you need to perform are upload them a debt relief letter (to own loan companies, you will find the address contained in this list of commercial collection agency agencies). Although not, compensated debts damage your credit rating, which makes which a history-resort choice.

Be mindful about making money to the early bills.

Debt collectors can be sue you having debts that you owe as the much time due to the fact they are inside law out-of constraints into the obligations in your state. Immediately after a loans has passed the fresh new law away from limitations, you can’t feel sued regarding it. Although not, and come up with an individual payment timely-barred obligations tend to reset this new clock into statute regarding constraints, adding one litigation.

Long-identity credit repairs

As the strategies intricate over can also be replace your credit history immediately, it probably cannot be enough to have it to the a great variety.

The particular schedule relies on several facts, together with your credit history and you can exactly what bad goods are on your own credit report.

step one. Prevent later money

For many who cannot have enough money to spend your own costs, that means you can make use of reduced credit. As well, if you have the money however, you are nonetheless not able to score your repayments for the on time, next try these tips:

- Set-up autopay: Which pledges that you wont skip a fees. With regards to the company and kind away from borrowing account, you could also score a reduction in your interest rate to have signing up for autopay.

- You should never skip a payment just because the late: Creditors wont statement a late fee up to their at least 29 months late. nine You might be able to prevent a fall on your get if you make the full commission prior to thirty day period have gone-by (though your creditor may charge your a later part of the payment or increase your own rate of interest).

2. Be strategic concerning your repayments when you are springing up small

For those who cannot can pay for to repay all your valuable expense, you could eliminate what number of bad marks on the credit declaration of the prioritizing and this expenses to spend and when to blow her or him. Recall the next affairs:

-

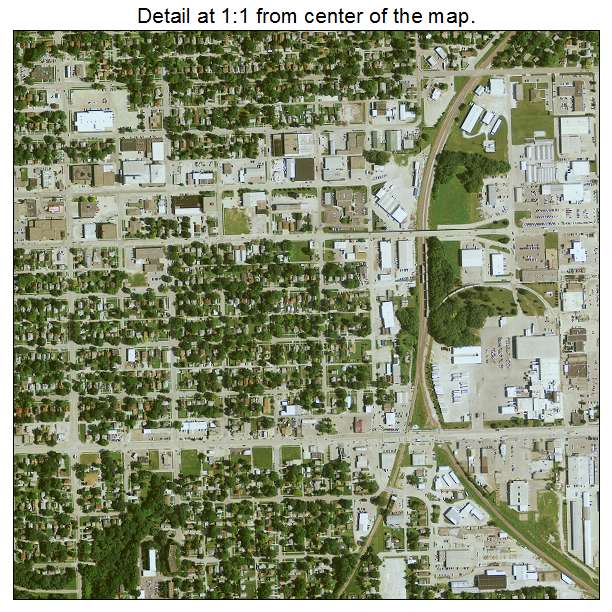

loans Monte Vista

- Just how many late levels issues over the amount your owe: Regarding late money, the credit bureaus look at the a beneficial $twenty five loans exactly the same way theyd evaluate an effective $dos,000 personal debt. Try everything you could potentially to reduce the number of late money you’ve got, in the event it means owing regarding you to definitely account.

- Your shouldnt outline limited repayments: If you dont have enough money to expend a bill, next wait until you may have adequate. Do not submit a partial payment. Creditors will statement a partial fee because a late commission, nonetheless will not statement a complete commission whether it was just a short while late.

- Revolving membership amount over installment profile: Whenever settling your financial situation, you might want to prioritize credit cards more cost financing money due to the fact revolving borrowing from the bank has a higher weighting in the Numbers Due sounding the fresh FICO scoring design. ten You should always help make your minimum monthly premiums to your one another to eliminate taking on derogatory scratching however, prioritize settling the rotating obligations whenever you can.

step 3. Believe taking out fully a cards creator mortgage

Borrowing from the bank creator funds arent most fund on the old-fashioned experience, however, theyre an excellent way off improving your credit score with limited risk.