A debt ratio of 30% may be too high for an industry with volatile cash flows, in which most businesses take on little debt. A company with a high debt ratio relative to its peers would probably find it expensive to borrow and could find itself in a crunch if circumstances change. Conversely, a debt level of 40% may be easily manageable for a company in a sector such as utilities, where cash flows are stable and higher debt ratios are the norm. As noted above, a company’s debt ratio is a measure of the extent of its financial leverage. Capital-intensive businesses, such as utilities and pipelines tend to have much higher debt ratios than others like the technology sector. The debt ratio is a financial leverage ratio that measures the portion of company resources (pertaining to assets) that is funded by debt (pertaining to liabilities).

What is your risk tolerance?

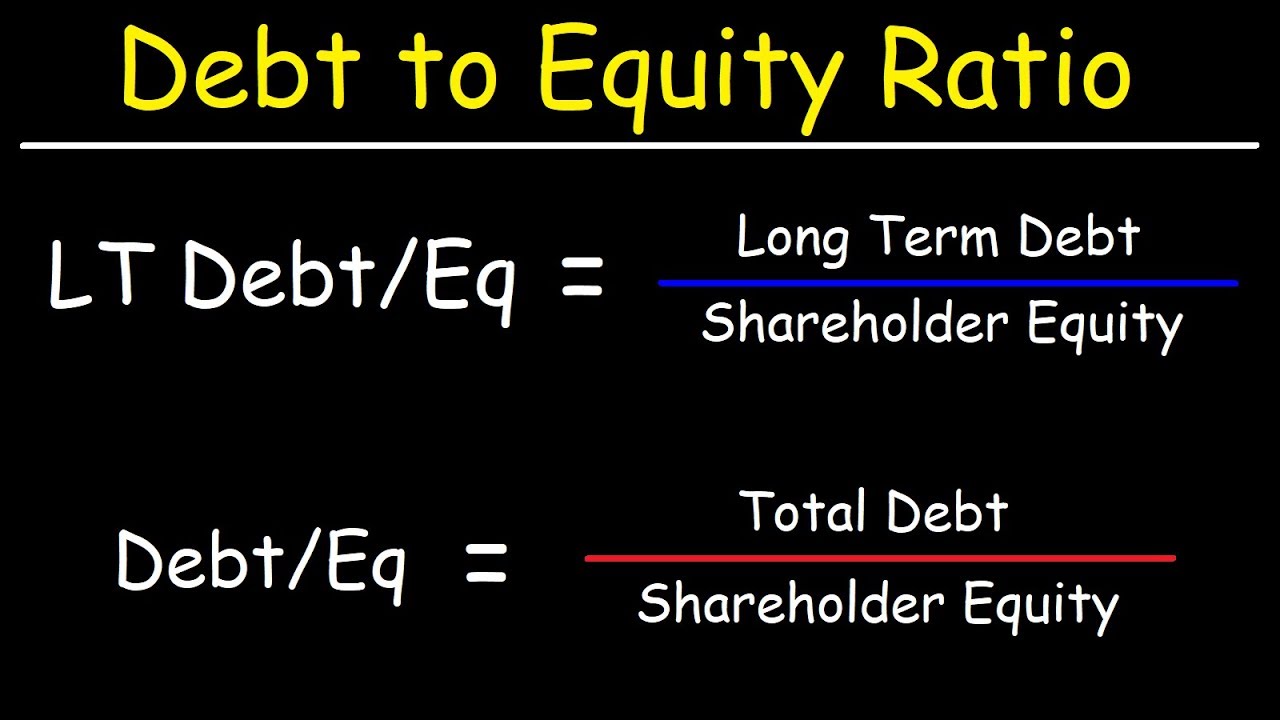

For example, if my total monthly debts amount to $1,500 and my gross monthly income is $5,000, my DTI ratio would be 30% ($1,500 ÷ $5,000). The debt to asset ratio is used to assess the proportion of a company’s assets financed through debt, indicating its leverage and financial risk. The Debt to Equity ratio is a financial metric that compares a company’s total debt to its shareholder equity. On the other hand, a low debt ratio, typically below 0.3 or 30%, suggests a company primarily uses equity to finance its operations.

- Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support.

- Generally, a D/E ratio of more than 1.0 suggests that a company has more debt than assets, while a D/E ratio of less than 1.0 means that a company has more assets than debt.

- On the other hand, the typically steady preferred dividend, par value, and liquidation rights make preferred shares look more like debt.

- Think about how these ratios compare to other financial ratios, and we’ll get into that in the next section.

- For example, Nubank was backed by Berkshire Hathaway with a $650 million loan.

Why You Can Trust Finance Strategists

This result indicates that 40% of your income goes toward monthly debt obligations, which offers insight into financial flexibility for RV financing. However, it’s important for investors and financial analysts to interpret the debt ratio in the context of the overarching economic conditions and within the specific industry framework. What may be deemed as an acceptable and promising high debt ratio in one sector or economic climate, might be a warning signal in another. However, it’s also essential to note that while a lower debt ratio might open more pathways for CSR initiative financing, it doesn’t automatically translate to a company choosing to invest in CSR. Other factors such as an organization’s policy on CSR, its current operational needs, and the expected returns on CSR investments also play a significant role.

Company

For example, a business with a steadily decreasing debt ratio is likely improving its financial health, which may make it a more attractive candidate for a loan or line of credit. Conversely, if a business’s debt ratio is increasing over time, lenders might view this as a red flag. In addition to influencing whether to provide a loan or extend credit, the debt ratio can also impact the terms of the loan itself. Businesses with a lower ratio might qualify for more favourable lending terms, such as lower interest rates or longer repayment periods.

Importance of the Debt to Equity Ratio

In essence, assessing a company’s debt ratio is like checking its financial heartbeat. Just as a steady pulse is a sign of physical health, a sustainable debt ratio can be an indicator of enduring business operations. This places emphasis on the importance of keeping a balanced business debt health for long-term financial viability. For investors, firms with an average debt ratio may present a balanced risk-reward scenario, implying a more stable investment compared to highly leveraged entities.

This tells us that Company A appears to be in better short-term financial health than Company B since its quick assets can meet its current debt obligations. The D/E ratio of a company can be calculated by dividing its total liabilities by its total shareholder cash flow statement: what it is and examples equity. Basically, the more business operations rely on borrowed money, the higher the risk of bankruptcy if the company hits hard times. The reason for this is there are still loans that need to be paid while also not having enough to meet its obligations.

This method is stricter and more conservative since it only measures cash and cash equivalents and other liquid assets. Using the D/E ratio to assess a company’s financial leverage may not be accurate if the company has an aggressive growth strategy. In contrast, service companies usually have lower D/E ratios because they do not need as much money to finance their operations.

Put the details in the respective boxes and calculate the ratio instantly. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support.

This represents a blend of debt and equity financing, which may be perceived as a less risky and more sustainable model compared to a high debt ratio. The main reason is that interest on borrowing must be paid regardless of whether the business is generating cash or not. Therefore, excessively leveraged companies may become unable to service their debt, forced to sell off important assets, or– in the worst case scenario–declare bankruptcy. Companies can improve their D/E ratio by using cash from their operations to pay their debts or sell non-essential assets to raise cash. They can also issue equity to raise capital and reduce their debt obligations. The D/E ratio also gives analysts and investors an idea of how much risk a company is taking on by using debt to finance its operations and growth.

We can see below that for Q1 2024, ending Dec. 30, 2023, Apple had total liabilities of $279 billion and total shareholders’ equity of $74 billion. The first group is the company’s top management, which is directly responsible for the expansion or contraction of a company. With the help of this ratio, top management sees whether the company has enough resources to pay off its obligations.